It was thoughtful of Time to give this award to Ben on the day before his confirmation hearings.

Flashback: Ben's Award Winning Performance for Wall Street Begins....

Coming Soon: Ben Burns the Big Pile of Money...

Life after the Treasury's financial debacle was hard for Tim....

"Yeah, I eat it. It's good!... Need your taxes done?"

16 December 2009

Time's Man of the Year: In Ben We Trust

15 December 2009

$38 Billion Tax Break Granted to Citigroup to Help Improve the TARP Results

Maybe it's a mistake. Did Timmy have time to run their return on TurboTax?

Maybe it's a mistake. Did Timmy have time to run their return on TurboTax?

Well, at least it will make the results of the TARP program look better on paper if it drives up Citi's stock price by inflating their financial results. That's a plus, right?

I guess raising the credit card rates to 26% and free money from Ben was not enough to push Citi over its capital objectives in time for bonus season. We'll all have to really tighten our belts for this one.

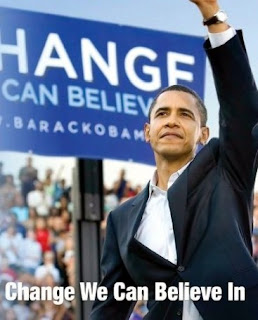

Change you can believe in.

Washington Post

Citigroup gains massive tax break in deal with IRS

By Binyamin Appelbaum

Tuesday, December 15, 2009; 8:05 PM

The federal government quietly agreed to forgo billions of dollars in potential tax payments from Citigroup as part of the deal announced this week to wean the company from the massive taxpayer bailout that helped it survive the financial crisis.

The Internal Revenue Service on Friday issued an exception to longstanding tax rules for the benefit of Citigroup and the few other companies partially owned by the government. As a result, Citigroup will be allowed to retain $38 billion in tax breaks that otherwise would decline in value when the government sells its stake to private investors.

While the Obama administration has said taxpayers likely will profit from the sale of the Citigroup shares, accounting experts said the lost tax revenue could easily outstrip those profits.

The IRS, an arm of the Treasury Department, has changed a number of rules during the financial crisis to reduce the tax burden on financial firms. The rule changed Friday also was altered last fall by the Bush administration to encourage mergers, letting Wells Fargo cut billions from its tax bill by buying the ailing bank Wachovia.

"The government is consciously forfeiting future tax revenues. It's another form of assistance, maybe not as obvious as direct assistance but certainly another form," said Robert Willens, an expert on tax accounting who runs a firm of the same name. "I've been doing taxes for almost 40 years and I've never seen anything like this where the IRS and Treasury acted unilaterally on so many fronts."

Treasury officials said the most recent change was part of a broader decision initially made last year to shelter companies that accepted federal aid under the Troubled Assets Relief Program from the normal consequences of such an investment. Officials also said that the ruling benefited taxpayers because it made shares in Citigroup more valuable and asserted that without the ruling, Citigroup could not have repaid the government at this time. (Thank God. Just in time for prime bonus season - Jesse) "This guidance is the part of the administration's orderly exit from TARP," said Treasury spokeswoman Nayyera Haq. "The guidance prevents the devaluing of common stock Treasury holds in TARP recipients. As a result, Treasury can receive a higher price for this stock, which will benefit the financial system and taxpayers." (George Orwell would have fun with this one. Let's give them a lot more money, so that when they give some back it will make our government program look better - Jesse)

"This guidance is the part of the administration's orderly exit from TARP," said Treasury spokeswoman Nayyera Haq. "The guidance prevents the devaluing of common stock Treasury holds in TARP recipients. As a result, Treasury can receive a higher price for this stock, which will benefit the financial system and taxpayers." (George Orwell would have fun with this one. Let's give them a lot more money, so that when they give some back it will make our government program look better - Jesse)

Congress, concerned that the Treasury was rewriting tax laws, passed legislation earlier this year reversing the ruling that benefited Wells Fargo and restricting the ability of the IRS to make further changes. A Democratic aide to the Senate Finance Committee, which oversees federal tax policy, said the Obama administration had the legal authority to issue the new exception, but Republican aides to the committee said they were reviewing the issue.

A senior Republican staffer also questioned the government's rationale. "You're manipulating tax rules so that the market value of the stock is higher than it would be under current law," said the aide, speaking on condition of anonymity. "It inflates the returns that they're showing from TARP and that looks good for them." (And a nice accomplishment for Timmy's year end performance review - Jesse)

Read the rest here.

Comex Acts to Curb Speculation (in Gold)

Did J. P. Morgan send up a flare as their short positions were taking on water and listing?

"As a heads up, Gold often gets hit with a bear raid on FOMC day. Since the

miners were hit a bit today with possible front-running that might be a good

bet. Who can say in these thin markets?"

Is the US Financial Crisis Over? 1:49 PM

And After the Bell...

"The COMEX gold margin requirement is going up overnight. New levels are $5403 initial per contract (the old one was $4500), and $4002 maintenance."Change you can believe in. Vox pecuniae and all that. LOL Why raise the margin requirments now after a ten percent correction?

The bullion banks (the bears) are edgy because the buying has been particularly robust in the physical metal at this price level, especially the further one gets from New York. Open interest in the futures has been remarkably resilient, showing very little long liquidation. A failure of the commercials is never a pretty sight.

Let's see if the Wall Street Banks can hold their ground and keep shorting into the demand from overseas.

US Dollar Daily Chart And a Brief Comment on Estimated M3 and the Velocity of Money

If the dollar is going to manage a breakout from this counter-trend bounce, this is about the point where it should show some strength.

Perhaps the FOMC tomorrow will provide the impetus.

If it cannot move higher from here, the trend line may provide some support, but at a much lower level from here.

There is some excitement on chat sites from the dollar bulls with regard to the downtrending estimates of M3, as presented by our friend Bart at nowandfutures.com.

M3, as you may recall, is no longer tracked by the Fed, having discontinued its publication on 23 March 2006. But both Bart and John Williams estimate it from the available data on two key components, and extrapolations from prior relationship for the key missing variable which is Eurodollars.

We prefer to watch MZM as we have noted, and that chart is also showing a decline, but perhaps not as dramatic as the estimated M3.

There is a problem in estimated Eurodollars these days, and since that was the key driver behind the recent short squeeze as documented here many times, we tend to discount the reliability of the M3 estimates. We have discussed this with Bart, who realizes that he is estimating his best. We could do no better, and his work is above reproach, but based unfortunately on Federal Reserve opacity.

His site is a regular source of information, and his work is excellent. John Williams does great work as well on his shadowstats.com site. We just think that there M3 estimates are becoming less reliable with time.

We also have to caution the dollar watchers that the nominal levels of money supply are only one half of the function of value. Demand is the other half of that function, and with the US economy flat on its back, one would expect the nominal money supply figures to be declining. The velocity of money is cratering, and the liquidity that is in the system is flowing into an echo equity bubble, and not into productive economic activity. The result is a growing Federal budget deficit.

Speaking of the velocity of money, Dave Rosenberg notes today the correlation between the velocity of money, nominal GDP / M1, and the SP 500. We don't like to reference M1 since the Fed changed the overnight sweeps policy, gutting M1 in the process, but Dave's point is well taken. GDP and stocks should be correlated, and velocity of money is an indicator of monetization gaining traction in the productive economy.

Here are some other widely followed measures of the Velocity of Money Supply.

In closing, here are a few astute observation on the Federal Reserve Note from an interview by Ron Paul on CNBC. It would have been interesting if he had been elected President rather than the Great Reformer, although it is charitable at best to call that a 'long shot.' Maybe next time if America turns from the established two party system. It would be a change to see more third party and independent members of Congress.

Is the US Financial Crisis Over?

This frankness and honest statement of the situation is the reason that Paul Volcker, one of the most credible advisors in the Obama Administration, is a marginalized voice as compared to Larry Summers and Turbo Tim. Ironic, because only by assuming Volcker's leadership style can the US President hope to get his country out of this cycle of monetary bubbles, systemic fragility, and chronic imbalances driven by an outsized, counterproductive financial sector.

DER SPIEGEL: But even though there are still more people being fired than hired, the Chairman of the Federal Reserve Ben Bernanke is saying that the recession is technically over. Do you agree with him?

Paul Volcker: You know, people get very technical about these things. We had a quarter of increased growth but I don't think we are out of the woods.

SPIEGEL: You expect a backlash?

Volcker: The recovery is quite slow and I expect it to continue to be pretty slow and restrained for a variety of reasons and the possibility of a relapse can't be entirely discounted. I'm not predicting it but I think we have to be careful.

SPIEGEL: What is the difference between this deep recession and all the other recessions we have seen since World War II?

Volcker: What complicates this situation, as compared to the ordinary garden variety recession, is that we have this financial collapse on top of an economic disequilibrium. Too much consumption and too little investment, too many imports and too few exports. We have not been on a sustainable economic track and that has to be changed. But those changes don't come overnight, they don't come in a quarter, they don't come in a year. You can begin them but that is a process that takes time. If we don't make that adjustment and if we again pump up consumption, we will just walk into another crisis.

SPIEGEL: The US has not yet instituted any kind of reform policy. What we see is the government and the Federal Reserve pouring money into the economy. If one looks beyond that money, one sees that the economy is in fact still shrinking.

Volcker: What should I say? That's right. We have not yet achieved self-reinforcing recovery. We are heavily dependent upon government support so far. We are on a government support system, both in the financial markets and in the economy...

The rest of the interview can be read here

The net Treasury International Capital flows came in light today at 20.7B versus 38.7B expected. GE was a drag on the big caps because of Immelt's lack of enthusiasm for any US recovery.

As a reminder, tomorrow the FOMC will make its December rate decision public at 2:15 EST. Traditationally there will be shenanigans abounding. In the morning the US will be revealing its premiere fantasy economy number, the Consumer Price Index.

As a heads up, Gold often gets hit with a bear raid on FOMC day. Since the miners were hit a bit today with possible front-running that might be a good bet. Who can say in these thin markets?

The US economy is much like this stock market rally: big on show and thin on substance.

Is the Price of World Silver the Result of Legitimate Market Discovery?

"...one US bank, JPMorgan, now holds 200 million ounces net short in COMEX silver futures, fully 40% of the entire net short position on the COMEX (minus spreads). As I have previously written, JPMorgan accounted for 100% of all new short selling in COMEX silver futures for September and October, some 50 million additional ounces. As extreme as JPMorgan’s position is, there is a total true net short position of 500 million ounces (100,000 contracts) in COMEX silver futures. Try to put that 500 million ounce short position in perspective. It equals 75% of world annual mine production, much higher than seen in any other commodity.

This makes claims that the COMEX short position represents a legitimate hedge of mine production a lie. The total short position represents almost 100% of the total visible and recorded silver bullion in the world, and 50% of the total one billion ounces thought to exist."

One cannot tell what is truth here easily, because of the still much too opaque nature of the US markets. But I do have a bias here, and I must disclose it up front. I have little confidence in the ability of the US regulators to do their jobs competently, and now approach anything that is said by the Obama administration regarding the financial markets with great skepticism.

In a fair market with transparent and symmetric distribution of key price information the identity of any holders of positions of over 5% of the market would be made known, so that people might understand the character of the market.

Further, any justification for these outsized positions and the 'backing' for them should also be made known publicly, and not just to a few insiders or regulators who expect to be trusted when past history shows that US regulators cannot be trusted to manage their markets reliably.

If this information about the silver market is indeed true, if J.P. Morgan is this short the silver market and unable to deliver even under duress, then perhaps the US should close down the Comex, because it has shown itself unable to be the price setter for the rest of the world in a metal with such broad industrial usage.

If it is not true, then the CFTC should publish its findings from its latest study of the silver market, and give the public the assurance that there is no manipulation in the silver market, and most importantly, why.

We have little confidence in the Obama Administration these days, which includes CFTC chairman, Clinton Alumni and ex-Goldman partner Gary Gensler as well, despite tough talk about position limits to quell speculation.

"The time for talk is over" should be a general theme in the Obama presidential term. They talk a good game, but never seem to deliver any meaningful reforms already promised, except those that might favor their own special interests.

This is important. It is important because in free markets producers must commit substantial amounts of capital in exploration and production to insure an adequate supply of any industrial commodity. And purchasers and other buyers and investors must be able to make their decisions with confidence.

Other parts of the world are moving towards establishing their own market clearing mechanisms in oil and key commodities outside of the sphere of the Anglo-American exchanges. If London and New York would prefer to continue to see their importance decline, then failing to regain the trust of the world through transparent reform after the enormous scandals that are still shaking world markets and financial systems would be advised, as they continue to do today.

It is not about pay. It is not about worrying that the traders might leave. It is time to show some concern for your customers, and about honest price discovery in a fair market, and making good after you have engaged in a massive fraud which the US and the Wall Street banks seem loathe to discuss when they worry about 'confidence.'

Is Mr. Butler wrong? Good, then show us why, not by belittling him personally, or picking details out of what he says and twisting them to try to undermine the whole of what he has to say. Public records show that there is an enormous short position in the silver metals market, that looks to be utterly out of bounds with physical reality and deliverability. If this is just a paper game then we need to know who is doing it and why, and why the world should accept this sort of nonsense as a basis for real production and real capital allocation.

And if this extreme speculation in silver is shown to be true, how do we know if this is the case in other US exchange based markets, like oil, and energy, and other metals, and food? Can the world afford to allow the US to set prices given the flaws which have been disclosed in their risk ratings and pricing mechanisms of late, despite the stony silence of their compliant media and the assurance of captive regulators? The pervasive fraud involved in the latest banking scandals has not yet been addressed adequately, and it is part of a pattern of misconduct going back to the 1990's at least. And even now, little or nothing has changed. The Partnership Between Wall Street and the Government Will Continue Until the System Collapses?

Show us the market. Show us who is holding the outsized longs and shorts, and what their motivations might be, whether it is a hedging producer, or as an agent for users and who they might be. And who the speculators are, and what limits on speculative manipulation might exist.

Show us the market. Show us who is holding the outsized longs and shorts, and what their motivations might be, whether it is a hedging producer, or as an agent for users and who they might be. And who the speculators are, and what limits on speculative manipulation might exist.What sort of leverage is JPM employing? Are they hedging proven reserves for legitimate customers, or are they shoving prices around the plate using derivatives, simply because they can. It does not reassure us that in the not too distant past the London group of AIG was a major short side speculator in the silver market.

There is too much trading in insider and asymmetric information in the US markets, which is the cause of their opacity and the recent successes of con men, sometimes despite the repeated attempts by concerned market participants to bring suspected abuses to the attention of the regulators in what were later found to be obvious and outrageous frauds.

And as for reassurances that the regulators have conducted a study, with the details withheld, and have in their considered opinion found nothing amiss, don't make us laugh. After the Madoff Ponzi Scheme, the Enron energy manipulation, and the mortgage CDO scandal, US regulators have amply demonstrated their inability to manage their stewardship honestly and competently. At this stage they should be making amends and regaining confidence, and not dictating terms to a bunch of helpless domestic customers who continue to accept such shoddy and arrogant treatment by self-serving financial institutions, who dare to charge even good customers 26% credit card interest rates and outrageous fees, in the spirit of the Obama financial reform.

If the world were of a mind to it, they could buy those futures contracts, and demand physical delivery, and bring Wall Street to its knees. Except as we know it would not work, because the exchange would dictate terms, a settlement in paper, and Ben would provide it, at the buyer's ultimate expense. This is the degraded nature of the US dollar reserve currency regime as it exists today. It is become, as they say in Chicago, a 'racket.' Time for honesty again. This is the reform for which the American people elected a new government.

But yet even today, there is a lack of self-awareness, a lack of proportion and an ignorance of history, that allows many otherwise educated and responsible people to make statements like this excerpt quoted below, a neo-colonial variation of the white man's burden, and bet their future that this dependency on the Wall Street banking cartel will be sustained in perpetuity, because it is a kind of a natural law. This point of view is not an aberration, and underlies the comments of many Anglo-American financial institutions today.

"The dollar is the backbone of the world central banking system. It is the backbone of the China money system. The white cliffs of Dover are as likely to collapse."I am not saying that Mr. Butler is right. I am saying that I no longer trust your markets and their integrity, and the honesty and competency of your agencies and regulators. And there is a groundswell of people around the world, and a quiet but growing majority in your own country, who feel the same way.

Extreme Speculation

By Ted Butler

...The main reason for my recurring thoughts that silver trading may be terminated on the COMEX someday is because that exchange is at the heart of the silver manipulation. If we are closer than ever to witnessing the end of the long-term silver manipulation, as I believe, it must mean an end the extreme concentration on the short side of COMEX silver futures. But the concentrated short position in COMEX silver futures is so extreme, that it is hard to imagine how it can be resolved in an orderly manner. The most recent data from the CFTC indicate that one US bank, JPMorgan, now holds 200 million ounces net short in COMEX silver futures, fully 40% of the entire net short position on the COMEX (minus spreads). As I have previously written, JPMorgan accounted for 100% of all new short selling in COMEX silver futures for September and October, some 50 million additional ounces. You have not seen anyone refute those findings, nor is it likely that you will.

So extreme is JPMorgan’s silver short position that it cannot be closed out in an orderly fashion. How could such a large position be closed out quickly, or otherwise, without strongly disturbing the market? If it could be closed out, it is reasonable to assume it would have already been closed out or greatly reduced to avoid the allegations of manipulation it raises. It’s not like the banks are presently universally loved and admired. The intent of anti-concentration guidelines and surveillance is to prevent the precise monopoly that JPMorgan has amassed on the short side of COMEX silver. Having erred egregiously in allowing this concentrated short position to develop, the CFTC is stuck with coming up with a solution to disband it. There is no easy solution.

Further, it is not just JPMorgan’s 200 million ounce COMEX silver short position that threatens the continued orderly functioning of COMEX silver trading. As extreme as JPMorgan’s position is, there is a total true net short position of 500 million ounces (100,000 contracts) in COMEX silver futures. Try to put that 500 million ounce short position in perspective. It equals 75% of world annual mine production, much higher than seen in any other commodity.

This makes claims that the COMEX short position represents a legitimate hedge of mine production a lie. The total short position represents almost 100% of the total visible and recorded silver bullion in the world, and 50% of the total one billion ounces thought to exist. These are truly preposterous amounts. By comparison, the net total short position in COMEX gold futures, admittedly no slouch in the short category, represents a little over 2% of the gold bullion that exists (45 million oz total net COMEX short position versus 2 billion oz). When it comes to the amount of real material, or mine production, in the world backing up the COMEX silver short position, the word “inadequate” takes on new meaning.

Because of the extreme mismatch between what is held short on the COMEX and what exists or could be produced to be potentially delivered against the short position, a very dangerous market situation exists. It is this dangerous situation that haunts me and causes me to contemplate a closing of the COMEX silver market. It has to do with what I see developing in the silver physical market and by putting myself in the other guy’s shoes. The other guy, in this case, is Gary Gensler, chairman of the CFTC.

It seems to me that there may be real stress in the wholesale physical silver market. All the factors I look at, including flows into ETFs, the shorting of SLV, the decline in COMEX silver inventories, the strong retail and institutional investment demand in silver, the now growing world industrial demand, etc., suggest tightness and the potential for a silver shortage like never before. This, in essence, is the real silver story. In spite of a large and growing concentrated short position, the price of silver suggests that it is the manipulation that is under stress. At some point, a physical silver shortage will destroy any amount of paper short selling. We may be very close to that point.

When the silver shortage hits, the price will explode. On this, there is no question. Industrial users, at the very first sign of delay in silver shipments, will immediately buy or try to buy more silver than they normally buy, in order to protect against future operation-interrupting delays. This is just human nature. The world has never experienced a true silver shortage ever, so the price impact is clearly unknown. I’ll try not to overstate how high I think the price will go in a true silver shortage and how quickly it will occur, so that I don’t sound too extreme. But the price move will give new meaning to “high” and “fast.”

Please remember, I am only talking of the price impact of the industrial users scrambling to secure silver supplies for their operations. This has always been my “doomsday machine” future silver price event. I am not speaking of new investment demand or short covering. Users, anxious to keep their assembly lines running and their workers employed will care less about price and more about availability and actual delivery. The users will buy with an urgency and reckless abandon rarely witnessed. That the price explosion caused by user buying will destroy the shorts is beyond doubt. So certain and devastating will be this destruction, that you must start asking questions as to what the regulatory reaction is likely to be. This is where you must try to put yourself in the other guy’s shoes. When the industrial silver shortage hits and prices explode, what would you do if you were Chairman Gensler?...

Read the rest of Mr. Butler's essay here.

14 December 2009

The Bankers Summit and Some Significant No-Shows

Some White House Banking summit.

Some White House Banking summit.

A one on one with Jamie Dimon and a few second tier, TARP-bound moneylenders.

John Stumpf of Wells Fargo is running late but surely on his way. Tied up signing some last minute foreclosures. The opening topic must be how to spin 26% credit card interest rates as a consumer benefit.

Ken Lewis of Bank of America is there. LOL. Trying to pick up an unemployment check and cop a plea.

It appears that Goldman's Lloyd Blankfein, John Mack of Morgan Stanley, and Dick Parsons of Citgroup will not be able to make the meeting today with The One regarding executive pay and the failure to lend by the Wall Street Welfare Queens.

The excuses are not the usual: end of year performance reviews, too busy with the office redecorators, trying to settle the tab at Scores, on hold with the Neiman Marcus trophy-wife and office-chippy department, making plans to fix the Superbowl.

The boys were flying commerical to show their solidarity with the homeless people who fly coach, and are encountering traffic delays on their flights out of New York to Washington. Reagan National Airport is closed by fog. It doesn't get much more symbolic than that. Are Dulles and BWI are closed too? No. Jeez, these guys don't bother with alternate plans to visit the White House?

"We're sorry Timmy, but frankly the President DID call him a 'fat cat' last night on 60 Minutes. Did you really expect our guy to show up for coffee today like nothing happened? Larry had assured us that he knows his place. Besides, it worked better when he came up to see us the last time anyway."It would be cool to be sitting at the gate with Lloyd. Think he is schmoozing there with the people? "Bagels and coffees for the terminal, on me."

Jamie did not condescend to act the plebe, and flew down in his corporate jet. And we do think Vikram was particularly ballsy in sending a delegate, executive figurehead, with a note that he is too busy negotiating the repayment of TARP in order to secure those year end bonuses for the troops.

Note to Lloyd and John and Dick, if you are traveling commercial from NYC to Washington in the winter, you take the train. And if flying you leave early or come down the night before, with dinner at The Palm. I recommend the peas and onions as your side. Carville hangs at the bar sometimes. He's a fun kind of guy.

It is always iffy when flying into National in the winter, except on Oligarch Express. Even Senators know that, and their feet barely touch the ground when they walk.

The Wall Street boys don't bother to show up for a command performance at the White House on some lame travel excuse, except for house banker and Treasury Secretary to be Jamie. Lloyd doesn't need to be Treasury Secretary because he already has one.

This is too good. You can't make this stuff up.

Propaganda, Western Style: Moscow Memories II

As regular readers know, Le Proprietaire was doing business in Russia, mostly in Moscow and St. Pete, in the 1990's as part of the overall international business portfolio during his past corporate life.

It was an exciting and somewhat nerve-wracking experience, but one that vividly drove home certain lessons about government, currency, and the resilience of the human spirit that have served well in the following decade. Moscow Memories of 1997

I have to admit I was not aware of this series about Russia by the Wall Street Journal, given a long term preference for The Economist and The Financial Times. Thanks to Zero Hedge for bringing this story about it from The Nation (which I would have never read, being a long time conservative) about the Journal and Steve Liesman to light.

As someone involved there I can say that anyone who did not perceive the growing crisis was living in a bubble, or carrying some particularly optimistic slant in their outlook.

The decline of the Russian economy was oppressive, palpable, almost on everyone's mind. Hard to miss, even at the occasional showy party in English thrown by western corporations for an audience largely made up of ex-pats. The move out of the rouble into just about anything else with substance was becomng a groundswell, later to become unstoppable default. Any presentation about a Russian venture in the 1990's had better contain some plans regarding currency risk.

But why bring this up now? Le Cafe has no particular squabble with the Liesman, and since we do not watch CNBC anymore, are largely immune to whatever it is he says that does not appear in a youtube excerpt, generally involving his getting owned by Rick Santelli.

We bring it up because this article below exposes the typical modus operandi of the Western press, now and over the past twenty years. Carry a party line until the situation explodes, cover it up and distract the public with phony debates and verbal circuses, and then back to give breaking coverage of Armageddon, with a twist of shared guilt. No one is to blame.

Can you remember the coverage of the tech bubble of 2000 by the media? Giddy excitement as the numbers climbed higher, with reassurance as they turned down that this was just a temporary setback.

And I will never forget, as the stocks collapsed and people were wiped out, the CNBC regular arrogantly saying "Well, no one FORCED them to buy those stocks."

Keep this in mind, because we are nearing that point again, with the western media reassuring its public that all is well, while the insiders sell, and the grifters and grafters are draining the nation of its wealth, while the propaganda puppets mouth the slogans of the day. And after it blows up, they will shift gears without an afterthought, keeping the public mind moving on, trusting to the collective amnesia of a distracted populace.

As they said on Bloomberg this morning regarding the crisis just passed, 'We are all to blame; the regulators, the government, the rating agencies, the banks, and the public who was apathetic, who failed to act."

And then they moved on to let us know that Ashley Dupre will be providing a weekly advice column in the NY Post. Romance with a financial twist?

The difference here, at least it seems to me, is that the American public is still a believer in what the government says. The Russian people, at least by that time, did not. So perhaps there are a few more good years left.

The Nation

The Journal's Russia Scandal

By Matt Taibbi & Mark Ames

October 4, 1999

Just before Christmas in 1997, as a tumultuous stock-market

crisis ravaged emerging markets in every corner of the globe, readers of the

Wall Street Journal were treated to some good news: Russia was going to emerge

from the mess unscathed. While conceding that "few debt markets outside

Southeast Asia were hit harder by recent financial turmoil than Russia's," the

Journal's Moscow bureau chief, Steve Liesman, added quickly that "many analysts

believe an equally strong rebound may be in the offing." Moreover, Liesman

wrote, investors were rapidly coming to the realization that "Russia's problems

are far different and, for the moment, less dire than those that undermined

Asian economies." The December 16 piece was headlined, "Russian Debt Markets Due

for Rebound."

A few weeks later, Liesman and the Journal used even

stronger language to trumpet Russia's economic merits. They chided investors who

were too busy "fretting over Asia's financial crisis" to notice what they called

"one of the decade's major economic events: the end of Russia's seven-year

recession."

The Journal's prediction was more than a little precipitate.

Instead of getting better, things in Russia got worse. A lot worse. Nine months

after Liesman declared that Russia's debt market was due for a rebound, and just

over seven months after proclaiming the end of the Russian recession, the

Journal--like most US newspapers--found itself having to explain the near-total

collapse of Russia's economy and capital markets...

Read the rest here: The Journal's Russia Scandal - Matt Taibbi, The Nation 1999

13 December 2009

Reading for the Weekend

"The people asked him, “What should we do?”

He replied, “If you have two shirts, give one to the poor. If you have food, share with those who are hungry.”

Even public officials came to be forgiven and asked, “Teacher, what should we do?”

He replied, “Collect no more than the law requires, do not engage in graft and corruption.'

And What should we do?” asked some soldiers and peacekeepers.

John replied, “Do not extort money or make false accusations. Be content with your just wages.”

Luke 3:10-14

12 December 2009

The Trend in the Freddie Mac US Housing Price Index

I suspect that the US Treasury and the Fed will continue to monetize the decline in housing prices and the mortgage market. We may see an inflation so that this trend is never realized in nominal values. Ultimately, the government may bury most of the losses in a currency devaluation.

US Housing: Four More Years to Fall - Michael White "The exhaustive Freddie Mac price index fell 2% nationwide in the 3rd quarter and analysis of its data predicts prices will continue to fall for the next four years.

"The exhaustive Freddie Mac price index fell 2% nationwide in the 3rd quarter and analysis of its data predicts prices will continue to fall for the next four years.

While Freddie announced Tuesday that its purchase-only index has gained for the past two quarters, the “Classic Series” of the Conventional Mortgage Home Price Index, which includes refinance appraisals as well as purchase values, has fallen 9% from the high in June 2007 and 3.8% for this year.

The projections say homeowners have lost only $1 for every $3 they can expect to lose in the end.

The trends show values will fall for four years through September 2013. Readers should take this estimate as an educated guess. The estimate may have greater relevance than forecasts described in mainstream-media headlines which typically fail to place new data within a long-term trend..."

11 December 2009

About Those Strong November US Retail Sales Numbers

Gasoline Purchases.

Early deep discounts on electronics to spur Christmas buying and 'green rebates' on new appliances.

Higher prices. Subsidized purchases. Let's party!

The Correlation Between Gold and US Equities

The relationship between US equities and gold obviously changed around the middle of 2008.

But how has it changed? Has the correlation really reversed so dramatically?

Is this the result of the Fed's reflationary efforts? But has not the Fed does this many times in the past? What is the relationship with both of these markets with the US dollar, and that with the money supply?

Perhaps there is not a direct correlation but a relationship to other things that relate in common.

All good questions. Explanations will be coming, but we have not seen many that are any good. Most are simplistic and self-referential to the person's biases. So we will have to do it ourselves.

10 December 2009

Obama's Big Sell Out

This is an effective articulation of why so many Americans who voted for Barack Obama and 'change' and reform feel betrayed, and rightfully so.

The funny thing is, the result would most likely have not been all that different if McCain had won, except the world might be worrying quite a bit about his health, given his utterly unqualified successor, the Decider in a skirt. American politics sometimes appear to be more like competing crime families and special interests than legitimate alternatives to national governance.

Well, at least an American President has not appointed his favorite horse to the Senate -- yet.  Obama's Big Sellout

Obama's Big Sellout

By Matt Taibbi

Dec 09, 2009 2:35 PM

The president has packed his economic team with Wall Street insiders intent on turning the bailout into an all-out giveaway

Barack Obama ran for president as a man of the people, standing up to Wall Street as the global economy melted down in that fateful fall of 2008. He pushed a tax plan to soak the rich, ripped NAFTA for hurting the middle class and tore into John McCain for supporting a bankruptcy bill that sided with wealthy bankers "at the expense of hardworking Americans." Obama may not have run to the left of Samuel Gompers or Cesar Chavez, but it's not like you saw him on the campaign trail flanked by bankers from Citigroup and Goldman Sachs. What inspired supporters who pushed him to his historic win was the sense that a genuine outsider was finally breaking into an exclusive club, that walls were being torn down, that things were, for lack of a better or more specific term, changing.

Then he got elected.

What's taken place in the year since Obama won the presidency has turned out to be one of the most dramatic political about-faces in our history. Elected in the midst of a crushing economic crisis brought on by a decade of orgiastic deregulation and unchecked greed, Obama had a clear mandate to rein in Wall Street and remake the entire structure of the American economy. What he did instead was ship even his most marginally progressive campaign advisers off to various bureaucratic Siberias, while packing the key economic positions in his White House with the very people who caused the crisis in the first place. This new team of bubble-fattened ex-bankers and laissez-faire intellectuals then proceeded to sell us all out, instituting a massive, trickle-up bailout and systematically gutting regulatory reform from the inside.

How could Obama let this happen? Is he just a rookie in the political big leagues, hoodwinked by Beltway old-timers? Or is the vacillating, ineffectual servant of banking interests we've been seeing on TV this fall who Obama really is?...

Read the rest of the story at Rolling Stone online here -

Today's US Treasury 30 Year Auction

Well, it is year end.

But there is undeniably a strong move to the short end of the curve, especially by the big debt buyers like foreign central banks who prefer their maturities in the 3 to 5 year range or less, sans agences s'il vous plait. This was also seen in yesterday's Ten Year Auction.

As for domestic buyers, the yield curve preference is less an investment decision than an IQ test. Only Zimbabwe Ben and the Last Resort Boys, along with a few pension and insurance funds who are compelled by a government mandate to match duration of obligations, are buying the long end ten years and out.

There was nothing in Treasury Secretary Geithner's appearance before the cameras today to compel one to do anything but hide in short durations, preferably offshore. Mr. Secretary engaged in a battle of wits with Elizabeth Warren, with Le Crampe de Cervau coming out a bit on the short end himself as he attempted to justify the bailout of AIG at par.

As you may recall, Liz Warren is a prof at Harvard with a portfolio in the field of financial liquidations, and Tim's rhetorical wind was met with a blazing fire of informed incredulity. No Congressperson or money honey she.

When the time comes the longer duration will be an excellent buy again, but not until Fed Funds is around 20% or so. What is that, about 2,000 basis points to go? I'll make a note.

Maybe there will be a protracted monetary deflation and a stronger dollar to justify those four and a half percents of return over 30 years. And maybe Timmy will get a job NOT working for Wall Street or the Fed when he passes out of the Obamasphere next year, in favor of a seasoned financial consigliere more conversant with the management of a currency crisis. It is hard to just throw money at them.

Bonds down after poorly bid 30-year auction

By Burton Frierson

NEW YORK, Dec 10 (Reuters) - U.S. Treasury debt prices fell on Thursday, sending 30-year yields to four-month highs after a poorly bid long-bond auction rekindled worries over the huge federal budget deficit.

The government sold $13 billion of 30-year bonds in an auction that was weak on all measures and suffered from its year-end timing, when many financial market professionals are reluctant to commit funds for such long-term investments.

However, the gaping U.S. budget deficit will outlast the seasonal factors and some analysts worried that the sloppy long bond auction was a sign of tough times to come for a government that has tried to borrow its way out of a credit crisis.

"It was pretty ugly. The old lump of coal in the stocking," Kim Rupert, managing director of global fixed income analysis at Action Economics LLC in San Francisco.

"It is just going to be a difficult year ahead fiscally and with respect to monetary policy and also the markets. I think Today's 30-year auction could just be the harbinger."

The 30-year long bond US30YT=RR fell rapidly after the auction, pushing yields up as far as 4.51 percent, their highest since August.

They were last down 30/32, yielding 4.48 percent versus Wednesday's close of 4.42 percent.

The benchmark 10-year note fell 8/32, yielding 3.47 percent, versus Wednesday's close of 3.44. During the selloff, benchmark yields rose to a four-week high of 3.52 percent.

However, the market recovered from its worst levels as both 4.50 percent 30-year yields and 3.50 percent 10-year rates have been seen as attractive levels by some investors to get into bonds.

The 30-year auction ended this week's three offerings totaling $74 billion. Though that's below the weekly record of $123 billion set in October, it is a lot of debt to sell in a traditionally quiet time of the year....

SP Futures Daily Chart at 3:45 PM

From the "Gold Chart" post earlier today

"P.S. Around 3:20 NY Time some downside hedges went back on (gold 1130ish and SP futs 1105). The stock market is bifurcated between big caps and the broad index. Probably year end shenanigans but it makes me edgy. Probably another little cut and bleed, but it helps me sleep."It bothers to no end that they cannot get it back up to the top of the range.

That, and the bifurcated market in equities, favoring the big names over the broader markets. Looks like window dressing.

Volumes are high frequency gossamer. The 10 Year Treasury Auction results yesterday were odious. But, it is never this obvious or easy. The downside looks magnetic.

A twist is that gold has been traveling with the SP 500 these days. When that reverts to the 'norm' it is going to be a new ball game.

Worry worry.

Gold Charts

Gold is attempting to make a bottom here, looking to consolidate in the 1100 - 1120 area. The selling was a series of bear raids determined to shake out the new buyers and weak hands from a short term very overbought condition.

The bulls were asking for it, leading with their chins a bit as they say. Newbies tend to buy high, panic early, buy back in abruptly and stupidly, and get taken down again in the normal overbought correction cycle. Its a greed-fear thing.

Now that the easy gains have been made, the bears start running into physical problems, and attempts to push down the price become harder to obtain and less 'sticky.' Dips are met with buying. Its a funny seesaw really, with the price increases overnight when the BRIC's and the Mideast buy, and then decline when Wall Street and the City of London paper hangers move into action.

Remember, anything can happen. It's not over until it is over, and we cannot say it is over yet. Still, the overbought condition has been substantially worked off, if in a rather precipitous manner. If one took the chart's counsel to take profits on December 2, then the portfolio has cash to now buy back some trading positions. Remember we do not touch the long term positions while the bull trend is intact.

We are back up to 1/6 position, having made a small purchase at 1150, another at 1140, both with hedges for more downside, and a larger purchase in the 1120's.

Now we wait, and buy weakness in dips to 1100 while the trend remains intact. There is downside risk to 1070, with the long term trend remaining sound. There really is no need to rush into this. Most markets look like they are rangebound at the moment, and quite possibly into year end. Waiting for a break one way or the other makes compelling sense. No one knows the future.

We have taken the hedges off, at least for now, as holdings in miners are slight. Mining stocks are correlated with both bullion and the SP 500 and should be considered levered positions. What is funny here is that gold bullion and the SP 500 are moving together, which is not the usual relationship. It can be deceptive if it changes.

Unless the markets melt down which is not likely but which is always a possibility, the risk probability is much more favorable now. If you wish to guard against a meltdown, a hedge for a stock decline is easy enough to obtain. Watch your leverage. A change in trend is ALWAYS possible.

And if 'traders' come clumsily piling back into paper gold here, the trading desks will see it and skin them alive, charts or no charts. That is how markets overshoot targets.

A much more deliberate and long term approach to the markets is preferable for those who are not traders. That is about 90% of the people who read these blogs. For them, there should only be four or five trades per year, if that.

We have to look at all markets within the context of the economy in which they operate. As we have stated, our outlook for the real economy is still very gloomy. This is not a cyclical recession we are experiencing. We are in dangerous waters.

It really is going to come down to the willingness of the Fed and Treasury to monetize the next wave of bad debt that comes rolling in from the Commercial Real Estate markets, and fresh rounds of residential foreclosures.

That is what makes the difference between inflation and deflation in a fiat regime of the world's reserve currency: a policy decision, and the willingness or timidity of the rest of the world to challenge the status quo.

The middle ground between Scylla (monetization) and Charybdis (deflation) without a serious systemic reform looks like a nasty stagflation with a few big winners and many smaller players losing big, so that's the target, for now at least.

P.S. Around 3:20 NY Time some downside hedges went back on (gold 1130ish and SP futs 1105). The stock market is bifurcated between big caps and the broad index. Probably year end shenanigans but it makes me edgy. Probably another little cut and bleed, but it helps me sleep.

Gold Daily

Gold Weekly

09 December 2009

Treasuries Fall After Weaker Than Expected Results in the Ten Year Auction

Interest rates rose and stocks and commodities faltered a bit on the result of this ten year treasury auction which was weaker than this Bloomberg piece suggests.

Metals declined as a reflexive reaction to 'higher interest rates.' The hit on the metals preceded the release of the results, in yet another bear raid by the Wall Street banks holding undeliverable short positions.

Foreign central banks were noticeably light buyers, much preferring the shorter durations like the three year.

Primary Dealers took a big chunk of the offering. Current trends suggest that Ben will take it off their hands through monetization.

The Fed will be under signficant pressure to buy the bonds as the bias to the short end of the curve creates imbalances that precipitate a funding crisis, and a possible currency crisis, at the Treasury in 2010 if this trend continues. It is unlikely that they will raise rates when monetization is a viable, if not preferred, option.

Geithner looks likely to be replaced in 2010 by a Treasury Secretary who is more 'seasoned' and who will guide the US multinational banking industry through what could be later known as the currency wars, analagous to the trade wars that occurred in the Great Depression. One might even say that they are already underway.

Bloomberg

Treasuries Fall After $21 Billion Auction of 10-Year Notes

By Cordell Eddings and Susanne Walker

Dec. 9 (Bloomberg) -- Treasuries fell after the U.S sold $21 billion of debt maturing in 10 years, the second of three note and bond auctions this week totaling $74 billion.

The notes drew a yield of 3.448 percent, compared with the average forecast of 3.421 percent in a Bloomberg News survey of seven of the Federal Reserve’s 18 primary dealers. The bid-to- cover ratio, which gauges demand by comparing total bids with the amount of securities offered, was 2.62, compared with an average of 2.63 at the past 10 auctions.

“Investors are not sure they want to be holding this many Treasuries going into a year where duration is going to be extending and rates may go higher,” Suvrat Prakash, an interest-rate strategist in New York at BNP Paribas Securities Corp., said before the auction. BNP is one of the primary dealers, which are required to bid at Treasury auctions.

The yield on the current 10-year note rose five basis point to 3.44 percent at 1:02 p.m. in New York, according to BGCantor Market Data.

Indirect bidders, an investor class that includes foreign central banks, bought 34.9 percent of the notes at today’s auction. They purchased 47.3 percent at the November sale. The average for the past 10 auctions is 39.1 percent...

The spread between yields on 2-year and 30-year Treasuries touched 366 basis points as the U.S. prepares to sell $13 billion of bonds tomorrow. The last time the spread was so large was 1992, when the Federal Reserve cut interest rates to bolster growth after a recession...

Many Markets Are In Trading Ranges and Trends That May Hold Into Year End

Markets in the short term in the US are the hunting preserves of the proprietary trading desks of the Wall Street Banks and large hedge funds. No place for amateurs.

This is a major impediment to financial reform and economic recovery because it imposes a heavy tax on the productive economy, and produces a misallocation of capital and malinvestment in unproductive financial instruments and pyramid schemes.

Both the Democrats and Republicans serve their special interests and different monetary masters, and not the public. The news presented by the financial media channels is heavily nuanced propaganda.

SP 500 December Futures

Trading range between 1080 and 1115 with uptrend intact.

Nasdaq 100 December Futures

Trading range between 1760 and 1810 with uptrend intact

US Dollar Index Continuous Contract

Still maintains the patina of a safe haven, although some of this is a natural technical reversal in the carry trade.

Gold February Futures

Correction driven by a series of heavy handed bear raids led by a group of banks that are holding undeliverable short positions.

Profit seeking sellers do not step in to a market and pound it lower with concentrated selling. Open Interest is the 'tell.'

The Banks Must Be Restrained, The Financial System Must Be Reformed

There has been a loss of perspective with regard to the financial sector led by the Anglo-American banking interests.

There has been a loss of perspective with regard to the financial sector led by the Anglo-American banking interests.

This will have to change before there can be a sustainable economic recovery. This will be difficult to accomplish, because there exists a fusion of corporate and government desires to control the distribution of wealth and power that is opposed to any significant reforms.

"A certain type of person strives to become a master over all, and to extend his force, his will to power, and to subdue all that resists it. But he encounters the power of others, and comes to an arrangement, a union, with those that are like him: thus they work together to serve the will to power. And the process goes on." Friedrich Nietzsche, The Will to PowerUntil then the world will experience a series of asset bubbles and increasing disparity in wealth and political power between the productive and administrative sectors of the economy ad society. This will continue until it becomes unsustainable, and unstable. And then it will change, as it always does.

UK Telegraph

Ex-Fed chief Paul Volcker's 'telling' words on derivatives industry

By Louise Armitstead

9:41PM GMT 08 Dec 2009

The former US Federal Reserve chairman told an audience that included some of the world's most senior financiers that their industry's "single most important" contribution in the last 25 years has been automatic telling machines, which he said had at least proved "useful".

Echoing FSA chairman Lord Turner's comments that banks are "socially useless", Mr Volcker told delegates who had been discussing how to rebuild the financial system to "wake up". He said credit default swaps and collateralised debt obligations had taken the economy "right to the brink of disaster" and added that the economy had grown at "greater rates of speed" during the 1960s without such products.

When one stunned audience member suggested that Mr Volcker did not really mean bond markets and securitisations had contributed "nothing at all", he replied: "You can innovate as much as you like, but do it within a structure that doesn't put the whole economy at risk."

He said he agreed with George Soros, the billionaire investor, who said investment banks must stick to serving clients and "proprietary trading should be pushed out of investment banks and to hedge funds where they belong".

Mr Volcker argued that banks did have a vital role to play as holders of deposits and providers of credit. This importance meant it was correct that they should be "regulated on one side and protected on the other". He said riskier financial activities should be limited to hedge funds to whom society could say: "If you fail, fail. I'm not going to help you. Your stock is gone, creditors are at risk, but no one else is affected."

Times UK

‘Wake up, gentlemen’, world’s top bankers warned by former Fed chairman Volcker

By Patrick Hosking and Suzy Jagger

December 9, 2009

One of the most senior figures in the financial world surprised a conference of high-level bankers yesterday when he criticised them for failing to grasp the magnitude of the financial crisis and belittled their suggested reforms.

Paul Volcker, a former chairman of the US Federal Reserve, berated the bankers for their failure to acknowledge a problem with personal rewards and questioned their claims for financial innovation.

On the subject of pay, he said: “Has there been one financial leader to say this is really excessive? Wake up, gentlemen. Your response, I can only say, has been inadequate.”

As bankers demanded that new regulation should not stifle innovation, a clearly irritated Mr Volcker said that the biggest innovation in the industry over the past 20 years had been the cash machine. He went on to attack the rise of complex products such as credit default swaps (CDS).

“I wish someone would give me one shred of neutral evidence that financial innovation has led to economic growth — one shred of evidence,” said Mr Volcker, who ran the Fed from 1979 to 1987 and is now chairman of President Obama’s Economic Recovery Advisory Board.

He said that financial services in the United States had increased its share of value added from 2 per cent to 6.5 per cent, but he asked: “Is that a reflection of your financial innovation, or just a reflection of what you’re paid?”

Mr Volcker’s broadside punctured a slightly cosy atmosphere among bankers and regulators, assembled in a Sussex country house hotel to consider reform measures, at the Future of Finance Initiative, a conference organised by The Wall Street Journal.

Another chilling contribution came from Sir Deryck Maughan, a partner in Kohlberg Kravis Roberts, the private equity firm, who in the 1990s was head of Salomon Brothers, the investment bank.

Another chilling contribution came from Sir Deryck Maughan, a partner in Kohlberg Kravis Roberts, the private equity firm, who in the 1990s was head of Salomon Brothers, the investment bank.He warned delegates that many of the flawed mathematical techniques that underpinned banks’ risk management approaches were still being used, saying that the industry had not “faced up to the intellectual failure of risk management systems, which are still hardwired into many banks and many trading floors”.

Sir Deryck also questioned whether it was right that taxpayers should continue to underwrite many of those risks: “There’s something wrong about large proprietary risks being taken at the risk of taxpayers. The asymmetry will not hold. I’m not sure we’ve thought about that.”

Earlier Baroness Vadera, adviser to the G20 — and an adviser to Gordon Brown during the banking crisis — had warned the world’s most senior bankers that continental lenders had yet to acknowledge the scale of their losses and bad debts. She said: “It’s not the UK banks that have to come clean, but some of the continental banks still have issues.”

She added that, contrary to City assumptions, the supposedly hardline French and German governments were more relaxed about leverage and liquidity constraints than Britain and America.

The former UBS banker said that she continued to have nightmares about how close the British banking system came to collapse last year.

She also warned bankers that the G20 process was “like herding cats” and that one of the main problems with the group of the world’s wealthiest nations was that they did not want to give up national sovereignty and co-ordinate their behaviour.

Meanwhile, George Soros argued that CDS should be banned. The billionaire investor likened the widely traded securities to buying life assurance and then giving someone a licence to shoot the insured person.

“They really are a toxic market,” he said. “Credit default swaps give you a chance to bear-raid bonds. And bear raids certainly can work."

08 December 2009

They Were Making It Up as They Went Along - And Still Are

"Mr Kashkari admitted that he plucked “a number out of the air” when deciding with Mr Paulson how much funding to request from Congress for the Tarp."

A telling memoir of the financial crisis by neo-mountain man Neel Kashkari, soon to be maven of what he hath wrought at bond insiders firm Pimco. Where did the $700 Billion Paulson Plan come from? Neel simply made it up.

They not only did not know then, as should have been painfully obvious to anyone who looked at the ten page request for $700 billion or else, but they also do not know now. When you do not have the facts to support your case, employ fear, uncertainty and doubt (aka FUD factor).

There is an all too human tendency to give credit to planning and forethought to experts, particularly those in key positions, in both government and corporate life.

One of the most surprising things I learned as a young man working his way from the hinterlands of a multi-national behemoth into the lofty towers of headquarters is that quite simply, they do not know. They are too often just frightened people making it up as they go along. Decision making too often comes down to verbal acuity, cults of personality, tides of emotion, and totemistic tribalism.

And the scary part of course is that the same can be said of the Bernanke's Gamble today. They just do not know, but can only hope for the best, and make corrections as they go along. Ben is just doing what worked last time, with a modification for what has been perceived as the 'one big error' the Fed made in deepening and extending the Great Depression.

It is, after all, the best that can be done with what is hardly a science, more akin to medieval medicine than geometry. Bernanke, Master of Leeches.

But these modern day monetary witchdoctors are wielding enormous power over the people and the nations of the world, and they are most likely making it up as they go along, with all the avenues of corruption, groupthink, self-interest, and self-delusion that this implies.

It is hard to think of a better characterization of the Obama Administration than a dysfunctional US corporation led by a high profile CEO surrounded by mediocre functionaries with enormous egos and retinues, bounded by special interests, losing its long-time monopoly status, foundering on the unyielding rocks of change. The decline of the Soviet Union redux, writ larger.

Then as now, the world is giving 'the experts' far too much credit for knowledge and forethought, and most sadly, wisdom.

In February 2008, Mr Kashkari was charged with drafting an emergency plan in case the credit crunch became a full-blown financial crisis. By October the crisis had arrived and his ten-page plan became the blueprint for the banks' bailout that Mr Paulson presented to Congress.

Mr Kashkari admitted that he plucked “a number out of the air” when deciding with Mr Paulson how much funding to request from Congress for the Tarp.

He told The Washington Post that he used his BlackBerry to calculate the bailout figures: “We have $11 trillion residential mortgages, $3 trillion commercial mortgages. Total $14 trillion. Five per cent of that is $700 billion. A nice round number.”

Recalling a conversation with Mr Paulson, he said: “It was a political calculus. I said, ‘We don't know how much is enough. We need as much as we can get . What about a trillion?' 'No way,' Hank shook his head. I said, 'Okay, what about 700 billion?' We didn't know if it would work. We had to project confidence, hold up the world. We couldn't admit how scared we were, or how uncertain.” The American Bailout Nightmare - Times London