What many traders are starting to realize is that the precious metals plunged with stocks in the recent market dislocation in 2008 because it was a 'liquidity crisis' among private institutions triggered by the credit unworthiness of individuals that provoked a general selling of assets.

What we are experiencing now is a sovereign debt (credit worthiness) crisis, which is really a currency crisis. A fiat currency is backed by nothing except the 'full faith and credit' of the issuer. It is not that it would have to be 'different this time' as some would think. It's not even the same thing, a different type of a crisis entirely.

The markets are assessing the risks of various currencies and countries with regard to default. Gold, and to some lesser extent silver bullion, are wealth that is sufficient to itself, requiring no backing from any particular country. Quite the opposite, there are large short positions and highly leveraged paper commitments, that present significant counterparty risk to the upside, because it is unlikely to be deliverable at anything near current prices.

Regulators have long turned a blind eye to what some contend are officially sanctioned shenanigans and secretive leasing and selling. This is becoming increasingly difficult for the central banks to manage, and we may approach a breaking point unless the financial engineers and politicians can head it off once again. They have a strong vested interest in hiding their past dealings, as we saw in the case of Mr. Gordon Brown in the UK.

If there is a new panic selloff, all assets will again be liquidated in the short term, including the metals. But their rebound may be quite sharp and potentially rewarding if the sovereign debt crisis continues, since the search for safe havens will be even more aggressive, as the seats in the shelters are quickly taken.

This is why the IMF is meeting in Zurich on May 11, ahead of the formal discussions scheduled later this year to discuss the reweighting of the SDR. There is a currency crisis on the horizon, and it may involve not only the PIIGS, but the larger developing countries including the US and the UK. And they are preparing contingency plans, and seeking to head it off.

I do not necessarily view this as gold and silver positive, because when central bankers get together to work their schemes on the markets, valuations may not be based on any fundamentals. The financial engineering of the central banks has been largely deleterious to individual wealth among the public, and there may be some shocking disclosures of market manipulation yet to be heard. The central bankers may be as compromised and hypocritical as their corporate cousins.

But if 'the fix is in' and the wealthy have indeed been buying bullion ahead of the public, then we might see something happen later this, and it could be quite impressive. The amount of 'book talking' being done on behalf of large institutions by paid analysts approaches the level of the appalling, even for such a recently tarnished profession.

By the way, the 'tease' today is that Jimmy Rogers is said to have turned rather bearish on stocks, and says he is getting quite short on one of the big western financial institutions which everyone believes is solid and well founded. He thinks it may soon become involved in the financial crisis. He would not reveal the name. We have a poll running until 9 PM Eastern US time for you to take your best guesses. No I did not include the US Treasury in the list.

As for the theory that currencies gain in strength if there are debt defaults, this is only if the taxation and production levels remain relatively constant or higher, and the debt destruction is within the debt which is owed by private parties. When sovereign wealth is destroyed this is a de facto default, and potentially corrosive as acid to a currency's value.

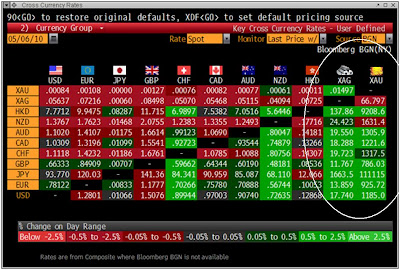

"Bullion denominated in euros and Swiss francs surged to new record highs this morning. The euro has again come under severe pressure as contagion risks increase. While all the focus is on Europe right now, similar risks face the UK and US economies and this is leading to significant safe haven demand for gold internationally. Prices have risen close to a new nominal record against the British pound and the highest level in yen since February 1983. Gold is slightly higher in most currencies this morning and significantly stronger in British pounds and euros - trading at $1,185.00, £786.03 and €925.72 per ounce this morning. Markets await the ECB rate decision and UK general election with interest."

Sovereign Debt Demands

"This is why the International Monetary Fund (IMF) and the Swiss National Bank (SNB) are jointly hosting a High-Level Conference on the International Monetary System in Zurich on May 11, 2010. The conference is set to analyse the global financial crisis and will provide an opportunity to exchange ideas on a number of related topics, including sources of instability in the international monetary system, improving the supply of reserve assets, dealing with volatile capital flows, and possible alternatives to countries’ accumulation of reserves as self-insurance against future crises.Metal Commentary by GoldCore

The conference will bring together a group of high-level participants, including central bank governors, other senior policymakers, leading academics, and commentators. The key objective of the conference is to examine weaknesses in the current international monetary system, and identify reforms that might be desirable over the medium to long run to build a more robust and stable world economy. The event will be concluded with a joint press conference by SNB Governor Philipp Hildebrand and IMF Managing Director Dominique Strauss-Kahn.

There is speculation that the conference may have favourable implications for gold with proposals that gold reserves may again have some form of role in bringing stability to the international monetary system."

Jim Rogers: More Turmoil Ahead in Global Financial Markets

Clusterstock: Jim Rogers Is Now Shorting A Major Western Financial Firm That Everyone Thinks Is Sound

As for my kitchen, we are plating financials short and bullion long all this week. But this may not be on the menu into the Friday US nonfarm payrolls, at least not in the same combinations and prices.