This is one of the big four 'quad witch' weeks for US equities, and Goldman is bring out some IPO's including the CBOE. So as previously said, we'll look for shenanigans on light volumes as the trolley dodgers try to stay out of the way of intermittent headline risks and keep that perfect trading score going.

When frauds like the US financial markets become this obvious and blatant, it is frequently a sign that they are nearing the endgame, or perhaps more properly, an implosion. But never poke a cornered skunk, you have to smoke them out.

Gold

Silver Daily Chart

Silver Weekly Chart

HUI Mining Index - Weekly Chart

Some might notice a trend on this chart. That trend would not hold up in a general stock market crash.

US Long Bond

Big Daddy looks about read to take a dump.

SP 500 Sept Futures Hourly chart

SP 500 Longer Term Cash Chart

SP 500 Correlated to Bernanke's Quantitative Easing Program

Chart Courtesy of James Turk

14 June 2010

Gold, Silver, and the Mining Index with the SP 500 for the 'Quad Witch' This Week

How I Learned to Stop Worrying And Love the Currency Collapse

If one reads this carefully, the BIS is really referencing a devaluation of about 22% which is hardly 'a collapse.' Here are some examples of post WW II currency collapses.

It depends on the timeframe, specifically the rate and extent with which the devaluation occurs. Also, it matters about what the devaluation has been against. Is it a relationship primarily to a reference point like the US dollar, largely affecting a narrow band of imports, or is it a true and general devaluation marked by soaring prices and monetary inflation domestically.

As I recall, China devalued the yuan by about 33% in the 1990's, and then pegged to the dollar, while 'persuading' first Bill Clinton (remember the Chinese campaign contributions scandal) and then George W. (whose family has a long history of supporting tyrannies for personal economic preferences) to allow them to maintain favored nation status, with the dispensation of 44% import tariffs, even while maintaining an artificially devalued currency, under full currency controls, and that fixed in a peg to the dollar.

"I am moving, therefore, to de-link human rights from the annual extension of Most Favored Nation trading status for China." --President Bill Clinton, announcing MFN status for China, White House, 5-26-94.

1994, Jan. 1 – China unifies its dual exchange rates by bringing the official and swap centre rates into line, officially devaluing the yuan by 33 percent overnight to 8.7 to the dollar as part of reforms to embrace a “socialist market economy”.As you may recall, in 1994 Bill Clinton also pushed through the NAFTA agreement which, in his words, would 'level the playing field' for American, Canadian, and Mexican workers. Only a few really understood the inherent danger in leveling the field without a thorough integration. The current Greek dilemma is a good example of a halfway done scheme in which monetary policy does not match up well with fiscal policy and national temperament.

When one uses globalization of trade to 'knock down barriers,' among the barriers that are placed at risk are things like the Constitutional safeguards which a free people enjoy in their own domestic method of organization, such as healthcare, the right to organize, freedom from indentured servitude, child labor, individual rights, and so forth.

These are the very barriers against the tyranny and despotism of the few on which the country was founded in a dramatically historical rebellion of the common people against the injustice of autocrats and empires. This was the rationale for the great Wars. Well, the one world government types play the long game, and if at first you do not succeed...

So yes, in this case China was able to export their structural employment problems largely to the US, which gutted its manufacturing sector primarily for the benefit of the Banks, who were able to cash in on the 'strong dollar' and the decline of government protection for its citizens from criminal control fraud.

Personally I think that high tariffs on Chinese goods would work much better for the US than a general currency devaluation per se given its position as a net importer, The downside would be that in the short term there would be less of a market for the export driven debts incurred by supporting the development of a non-democratic country engaged in blatant currency manipulation and mercantilism.

But do not fear, enough palms have been crossed so that one would never expect a simple solution to occur. Political and financial fraud dwells in the realms of artificial complexity. And the competitive but managed devaluations of currencies will serve to transfer more wealth from the many to the few quite well, a sort of hidden tax on the mob, while the wealthy continue to benefit.

But do not fear, enough palms have been crossed so that one would never expect a simple solution to occur. Political and financial fraud dwells in the realms of artificial complexity. And the competitive but managed devaluations of currencies will serve to transfer more wealth from the many to the few quite well, a sort of hidden tax on the mob, while the wealthy continue to benefit.But then again, the BIS may just be priming us for a crisis to come, which is consistent with the steady but quiet migration into gold by the wealthy, despite the propaganda they might put out for the masses to hear. As Pliny the Elder observed, "Ruinis inminentibus musculi praemigrant:" When collapse is imminent, the little rodents flee.

As an aside, here is a fairly good example of a man's thinking. Notice how Keynes changed his views of globalization from the euphoria of the British empire expressed the famous passage in "The Economic Consequences of the Peace" in 1920 which sounds like an Ode to the British Empire:

"What an extraordinary episode in the economic progress of man that age was which came to an end in August, 1914! The greater part of the population, it is true, worked hard and lived at a low standard of comfort, yet were, to all appearances, reasonably contented with this lot. But escape was possible, for any man of capacity or character at all exceeding the average, into the middle and upper classes, for whom life offered, at a low cost and with the least trouble, conveniences, comforts, and amenities beyond the compass of the richest and most powerful monarchs of other ages. The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, in such quantity as he might see fit, and reasonably expect their early delivery upon his doorstep; he could at the same moment and by the same means adventure his wealth in the natural resources and new enterprises of any quarter of the world, and share, without exertion or even trouble, in their prospective fruits and advantages; or he could decide to couple the security of his fortunes with the good faith of the townspeople of any substantial municipality in any continent that fancy or information might recommend. He could secure forthwith, if he wished it, cheap and comfortable means of transit to any country or climate without passport or other formality, could despatch his servant to the neighboring office of a bank for such supply of the precious metals as might seem convenient, and could then proceed abroad to foreign quarters, without knowledge of their religion, language, or customs, bearing coined wealth upon his person, and would consider himself greatly aggrieved and much surprised at the least interference. But, most important of all, he regarded this state of affairs as normal, certain, and permanent, except in the direction of further improvement, and any deviation from it as aberrant, scandalous, and avoidable. The projects and politics of militarism and imperialism, of racial and cultural rivalries, of monopolies, restrictions, and exclusion, which were to play the serpent to this paradise, were little more than the amusements of his daily newspaper, and appeared to exercise almost no influence at all on the ordinary course of social and economic life, the internationalization of which was nearly complete in practice."After a period of years we can see his shift in thinking, albeit reluctantly and with many caveats, towards practical National Self-sufficiency in 1933.

"I was brought up, like most Englishmen, to respect free trade not only as an economic doctrine which a rational and instructed person could not doubt, but almost as a part of the moral law. I regarded ordinary departures from it as being at the same time an imbecility and an outrage. I thought England's unshakable free trade convictions, maintained for nearly a hundred years, to be both the explanation before man and the justification before Heaven of her economic supremacy. As lately as 1923 I was writing that free trade was based on fundamental "truths" which, stated with their due qualifications, no one can dispute who is capable of understanding the meaning of the words...It is a long business to shuffle out of the mental habits of the prewar nineteenth-century world. It is astonishing what a bundle of obsolete habiliments one's mind drags round even after the centre of consciousness has been shifted. But to-day at last, one-third of the way through the twentieth century, we are most of us escaping from the nineteenth; and by the time we reach its mid point, it may be that our habits of mind and what we care about will be as different from nineteenth-century methods and values as each other century's has been from its predecessor's...For these strong reasons, therefore, I am inclined to the belief that, after the transition is accomplished, a greater measure of national self-sufficiency and economic isolation among countries than existed in 1914 may tend to serve the cause of peace, rather than otherwise. At any rate, the age of economic internationalism was not particularly successful in avoiding war; and if its friends retort, that the imperfection of its success never gave it a fair chance, it is reasonable to point out that a greater success is scarcely probable in the coming years...I sympathize, therefore, with those who would minimize, rather than with those who would maximize, economic entanglement among nations. Ideas, knowledge, science, hospitality, travel--these are the things which should of their nature be international. But let goods be homespun whenever it is reasonably and conveniently possible, and, above all, let finance be primarily national. Yet, at the same time, those who seek to disembarrass a country of its entanglements should be very slow and wary. It should not be a matter of tearing up roots but of slowly training a plant to grow in a different direction."

Quite frankly I do not expect the Fed and Treasury to ever let go willingly of the reins of the economy, or reigns of power if you will, through their aggressive financial engineering in partnership with the Banks. A return to normal will not be achieved without a significant amount of effort, conflict and most likely, pain. It appears to be unavoidable now. As you may recall, Dr. Strangelove was insane, and his dark vision affected the politicians around him. One has to wonder if Barack, Ben, Tim and Larry have their reservations made for a place in the mineshafts.

The customary price of freedom will be paid, as always. The light of freedom may be extinguished for a time, but like a spark that is cherished in thoughts and hearts of the true, will remain to be revived again on some future day.

Bloomberg

Currency Collapse May Stimulate Economic Expansion, BIS Says

By Matthew Brown

June 14 (Bloomberg) -- Currency collapses tend to spur a resumption of economic growth rather than fueling a decline in gross domestic product, according to the Bank for International Settlements.

Currency collapses are associated with permanent output losses of about 6 percent of GDP, on average, though the drop tends to appear beforehand, the Basel, Switzerland-based BIS said in its quarterly review yesterday.

“This suggests that it may not be the currency collapse that reduces output, but rather the factors that led to the depreciation,” Camilo E. Tovar wrote in the study. “To gain a full understanding of the implications of currency collapses on economic activity it is important to carefully examine the full circle of events surrounding the episode.” (How about the utter destruction of savings and the impoverishment of millions? That has a dampening effect as I recall from the stories that my grandparents told. - Jesse)

The positive effects of a weaker currency on GDP, including making local products cheaper than imported goods, may outweigh the negative ones, such as rising inflation. Currency collapses occur when the annual exchange rate drops by about 22 percent, according to the BIS, which identified 79 such episodes, “more commonly in Africa than in Asia or Latin America,” since 1960, Tovar said.

“They also occurred under all types of currency regimes, except possible floating-exchange-rate regimes, where there are simply too few observations to obtain meaningful estimates,” the BIS said.

Economic Contraction

The euro tumbled about 20 percent against the dollar between Nov. 25, 2009, and last week as investor concern over record budget deficits in countries including Greece spurred speculation the 16-nation currency union may split. The European Union in May crafted a 750 billion-euro ($908 billion) rescue package to stem the crisis.

Greece’s economy will contract 3.9 percent this year and 1.2 percent in 2011, after shrinking 2 percent in 2009, according to the median of eight economist estimates compiled by Bloomberg. The euro-region will expand by 1.1 percent this year and 1.5 percent in 2011, after falling 4.1 percent last year, median forecasts show.

Hans-Werner Sinn, president of Germany’s Ifo economic institute, said on June 3 that it would be best for Greece to leave the euro instead of implementing an austerity program to reduce its deficit. Greek Prime Minister George Papandreou pledged budget cuts worth almost 14 percent of GDP to bring the deficit within the EU limit of 3 percent by the end of 2014.

“The real solution for Greece would be to leave the euro followed by a depreciation” of the new currency, Sinn said in an interview at a conference in Interlaken, Switzerland.

Growth May ‘Dominate’

European Central Bank Executive Board member Lorenzo Bini Smaghi said on May 28 that there are “no alternatives” for Greece beyond following the austerity program.

“Before drawing policy conclusions we should emphasise that these results are subject to a number of caveats,” the BIS said in the report. “Most importantly, the analysis does not address the reasons why currency collapses occur in the first place. Our analysis also has little to say about the mechanisms involved after the currency collapse takes place. While we cannot disentangle the various factors, our results do suggest that expansionary mechanisms tend to dominate.”

Moody's Cuts Greece to 'Junk'

It certainly is nice to own the world's major ratings agencies.

Oh no, not the US government -- the Anglo-American hedge funds and a few multinational banks.

Bloomberg

Greece Cut to Junk by Moody’s on ‘Substantial’ Economic Risks

By Ben Martin and Maria Petrakis

June 15 (Bloomberg) -- Greece’s credit rating was cut to non-investment grade, or junk, by Moody’s Investors Service, threatening to further undermine demand for the debt-strapped nation’s assets as it struggles to rein in its budget deficit.

In making the four-step downgrade to Ba1 from A3, Moody’s cited “substantial” risks to economic growth from the austerity measures tied to a 110 billion-euro ($134.5 billion) aid package from the European Union and the International Monetary Fund. The lower rating “incorporates a greater, albeit, low risk of default,” Moody’s said in a statement yesterday in London. The outlook is stable, it said.

Greece has cut spending, raised taxes and trimmed wages to tackle the deficit, which swelled to 13.6 percent of gross domestic product last year, more than four times the EU limit. To secure the EU-IMF aid, the government pledged to trim the shortfall to 8.1 percent of GDP this year and bring it back under the 3 percent EU ceiling in 2014. The crisis has prompted investors to sell the bonds of Greece and other high-deficit nations and pushed the euro down 15 percent this year.

“We’ve got a lot of uncertainty around the growth outlook for Greece,” Sarah Carlson, vice president-senior analyst in Moody’s sovereign-risk group, said in a telephone interview yesterday. “It’s rare for a country to implement so much structural reform in a very short time...”

11 June 2010

Gold Daily Chart

There are a number of IPO's coming out next week, including one for the CBOE. Goldman Sachs is an underwriter on most of them.

This is also the June quad witch, one of the four biggest ones of the year. And the put/call ratio indicates a smackdown for the baby bears might be on deck.

So we might expect some shenanigans on the equity front, as they will try and support the markets while they get the IPO's priced and out the door. The primary downside risk there is 'headline risk' as volumes remain light. Few actually believe that there is an economic recovery.

So how will this affect gold and silver? It is hard to say, because the price manipulation is strong at this level of price, in front of a breakout that the central banks would find threatening.

So, we will wait and see what happens.

"Be on your guard against the leaven of the Pharisees, which is hypocrisy and deception. Everything that is secret will be brought out into the open. Everything that is hidden will be uncovered. What has been said in the dark will be heard in the daylight. What has been whispered to someone behind closed doors will be shouted from the rooftops." Luke 12:1-4

10 June 2010

Gold Daily Chart and a Look at Silver.

As we watch the Nasdaq 100 to confirm any moves in the SP 500 for stocks, so we watch silver to confirm any moves in gold for the metals.

Gold pulled back to the top of the handle today.

Silver has been moving sideways, and it appears to be coiling for a move.

It *could be* a large H&S top, and it could just be a back and fill consolidation prior to a leg higher. The funny thing about these formations is that one does not really know which way they are going until they show their hand. The value of the formation is to know when they are moving, and how far they are likely to go.

Notice that this H&S looking formation on the right is part and parcel of a larger inverse H&S that had a breakout that failed, for now, as a result of a concentrated shorting action by a few bullion banks. The neckline is still there, and the primary bull trend is still alive. Therein lies the tension on the tape.

SP 500 September Futures Daily Chart

Here is our first look at the SP 500 September futures contract.

There is quite a bit of up and down trading 'chop' in the past couple of weeks after the initial bounce took the price up to the 38.2% retracement level. We heard that Goldman took a big position in the SP futures this morning in the pits, and the rest of the day was a pumping of stocks to help ensure those daily gains.

Follow through is everything at this point as we are nearing a key resistance point.

DELL is halted after hours, announcing that it will delay its 10Q filing as a result of discussion with the SEC that will reducing its earnings in the neighborhood of 100 million dollars, or about 5 cents per share for the quarter.

09 June 2010

Gold Daily Chart: Update of the Cup, and the Long Term Golden Bowl

Now we can see if the backing and filling is over, and a base can be built for another try at the breakout.

A reader from Strasbourg sent this chart of inflation-adjusted gold, and suggested I take a look at it for a longer term 'cup and handle.' So I did some basic charting and calculation that are shown below.

That's not a cup, its a golden bowl!

Who knows if this is valid. Let's just call it gold bull porn, and leave it at that.

Here is a short clip from one of my favorite Russian films Дневной дозор, Dnevnoi Dozor, or in English Day Watch. It is the sequel to Night Watch, both under the direction of the Russian director Timur Bekmambetov who went on to create Wanted starring Angelina Jolie and James McAvoy.

I don't know why, but it seems appropriate to a discussion of the long term gold trend.

Rumour: BP To Cut Its Dividend Next Week, and Yet Another Goldman Sachs Stock Scandal

This is making the rounds as a rumour, but it has some credibility, and I have been expecting it as they need to set aside serious reserves for litigation and for the clean up of damages caused.

The company is in deep trouble, and the CEO is making all the classic errors we learned not to do in the crisis management courses in business school. Its shocking really at how badly he has performed.

The rumour is so widespread that I am sure it will make the wires in some form, if only a denial, and I will look for it. I do not expect BP to declare bankruptcy as this other story suggests, although it would be an interestingly foul gambit to try and avoid its liabilities.

British Petroleum had been at the heart of darkness many years ago, as in the example of the Iranian coup d'etat of 1953 and imprisonment of Iran's democratically elected leader Mohammad Mosaddegh, followed by over twenty years of tyranny and torture. Some think this is what had inspired Eisenhower's parting words about the Anglo-American military-industrial complex.

Although through aggressive use of public relations had improved their image, BP have long been noted by investigative reporters and environmentalists as a bad boy among the corporate multinationals, preferring to spend money on PR, politicians, and regulators rather than planning and safety. BP: Slick Operator and BP's Other Spill by Greg Palast for example, and those radicals at the Seattle Times: BP's Trail of Accidents and Scandals Lead to Alaska. When Sarah Palin, former governor of Alaska winks and says "I'm your gal," she just might not be winking at you, chump change.

And let us not forget the BP Texas City Refinery Explosion of 2005 and the urgent calls for more oversight and attention to safety.

I thought it was interesting that BP bought the search term "oil spill" from Google to better direct the flow of information from the public.

And then of course there is the issue of insider selling that occurred prior to the more complete release of the extent of the Gulf oil leak disaster involving BP executives and former executives, and of course Goldman Sachs. Gulf Oil Spill to Drag Goldman Sachs into Trading Scandal?

This is not to say that all corporations are corrupt all the time, not at all. But neither are they naturally good, all the time. It underscores the need for regulation, and investigations into the type of corruption which was apparently widespread in the agencies that regulated the banks, the oil drilling industry, and the stock markets. Maintaining a system of justice, the rule of law, is not something you do once and then sit back and then trust to the natural goodness of men and women to limit their profits and do the right thing when no one is watching. Especially when you permit corruption to create enormous temptations and opportunities in the spirit of 'greed is good.'

"How are the mighty fallen, and the weapons of their warfare perished." Slowly but surely.

And I see that the utterly discredited econo-propagandist Art Laffer is now on Bloomberg television being prompted with softballs from the corporatist spokesmodels Matt Miller and Carol Massar.

"O Rose thou art sick.Postscript: In case you are interested here is a brief, simple, but decent analysis of Blake's poem, The Sick Rose. The first twenty or so analyses that Google recommended would set my old teachers turning in their graves.

The invisible worm,

That flies in the night

In the howling storm:

Has found out thy bed

Of crimson joy:

And his dark secret love

Does thy life destroy."

William Blake, Songs of Experience

Net Asset Value of Certain Precious Metals Trusts and Funds

Interestingly, the Sprott premium has been driven down to near parity with that of GTU, which has no meaningful redemption policy for its gold.

I suspect this is the result of the ham-handed way in which Sprott managed its recent sale of additional units, and the munificence with which it delivered shares to the underwriters at prices well below the market. If I had done it that way, I would have been ashamed.

TORONTO, June 1 /CNW/ - Sprott Physical Gold Trust (the "Trust") (NYSE: PHYS / TSX: PHY.U), a trust created to invest and hold substantially all of its assets in physical gold bullion and managed by Sprott Asset Management LP, today announced that it has completed its follow-on offering of 24,840,000 Units at US$11.25 per Unit for gross proceeds of US$279,450,000 (the "Offering"). This includes the exercise in full by the underwriters of their over-allotment option.I do expect the PHYS premium to get back closer to long term trend after the excess shares are sold into the market and the profits of the underwriters are booked. The redemption feature is attractive, but the method in which Eric Sprott treated his shareholders may dampen future enthusiasm for his products.

This just serves to remind one that no trust or fund is a long term substitute for owning the real thing.

Gold Bulls Are In Their Cups and the Bull Market in Confidence Games and Voodoo Economics

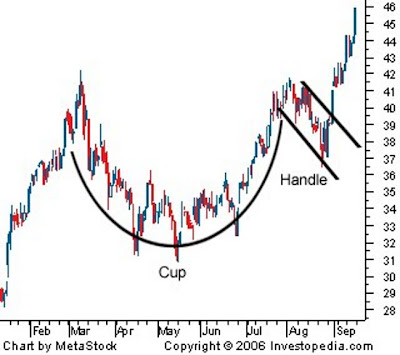

A friend and correspondent over at BullionVault reminded me the other day that some have been watching what they consider to be a larger cup and handle on the gold daily chart going back to 2008.

My depiction of that longer term chart formation is below.

I had carefully considered that interpretation last year but the handle formed much higher relative to the cup than I would prefer. Further, it did not form like a classic handle on the retracements. Instead I considered it to be a simple inverse Head and Shoulders continuation pattern in this bull market, from the extreme selling in the liquidity crisis.

The patterns have similar pricing objectives, unless you draw the lines as diagonals and attempt to measure off the top of the handle. Either way, each is a chart formation that is active and working with objectives north of where the cash price is today.

There are two reasons to use a cup and handle versus an inverse H&S. The first is that the breakout action on the handle is more easily charted and evaluated. A breakout through the neckline of any H&S is merely a binary event, whereas a handle permits more gradation. Head and Shoulder patterns are simple creatures. The second reason is that some people do not believe that an inverse H&S is an appropriate continuation pattern, and can only be used for a clear 'bottom' of a downtrend. I obviously do not agree with the latter. They can often act as continuation patterns after a severe selloff in a bull market trend that remains intact.

And there is of course, with the advent of modern computerized charting tools, the temptation to overcomplicate a chart and fill the page with far too many lines and circles and diagonal relationships to the point of obscurity, as though a Euclid of Alexandria had thrown up a lifetime of drawing on a basic price chart.

As an aside, sometimes readers will say things like 'So and So is a respected chart authority and he says...' And this is provided without justification, on the basis of authority. Well, one must always listen respectfully to learned opinions, but then look carefully at the empirical evidence, in a scientific manner, which in my book trumps theory and the 'rules' made by men.

When I was working at Bell Labs a very learned and internationally respected authority (and my boss' boss which was the ultimate power of that bureaucracy) told me that I "obviously did not understand information theory" when I presented the case for developing higher speed modems (> 9600 bps) , Digital Subscriber Line technology, and high speed local area transmission over unshielded twisted pairs, well in advance of their formative discussions on the CCITT and US IEEE committees. In other words, I have made my career in not accepting the conventional wisdom and authority of the day. Sometimes what you think you know prepares you for a world that no longer exists, because it was an illusion.

Far too many economists tell people what they wish to hear, or what their masters are promoting, and attempt to give it the trappings of respectability with professional jargon, self-referential theories and elaborate faux proofs, with the trappings of equations based on falsified assumptions. If you want to measure a contemporary economist, see what they are saying, if anything, about reforming and restructuring the financial system.

A government needs to decide first what sort of nation it wishes to be, and then use economics as one means of sorting out more granular choices among policy decisions. To treat economics as a primary determinant of social policy is to perpetuate the hoax of the efficient markets hypothesis and the inherent goodness of 'free trade.' But it does helps economists to gain funding from the plutocrats, and serves to divert the public from the discussion of meaningful reforms.

Finally, at this point in my third career, I AM a 'chart authority' of sorts in my little circle, and it is my money on the line when I am investing, so I think I have some say, at least in my own kitchen, as long as she-who-must-be-considered is out front. lol.

Here is a picture of the pullback on the cup and handle we have been watching for the past few weeks. So far it is as expected.

08 June 2010

Gold Sets a New All Time High

Gold spot price briefly spiked over 1250 before pulling back as speculators took profits, and metals bears put on fresh shorts in the hope of an overreach and a double top.

The breakout needs to take out the 1250 area and hold it, put a nail in it. It will likely back and fill before making its move. I have added the new short term fibonacci retracement levels to the chart.

There is something profound going on in the background of this market, making it well worth watching even if you do not have an investment interest in it specifically.

There is nothing wrong with selling strength and buying weakness to round out a trading position. But you never wish to lose your entire position in a bull market, because it becomes a formidable task to buy back in, a real effort of will and emotion to get back on the train once it has left your standing at the station. Rather than admit they were wrong, most amateur investors will instead become bystanders and spectators, jeering and cajoling the passengers to get off as well, so they do not feel so foolish and lonely as the bull market passes them by.

"For instance, I had been bullish from the very start of a bull market, and I had backed my opinion by buying stocks. An advance followed, as I had clearly foreseen. So far, all very well. But what else did I do? Why, I listened to the elder statesmen and curbed my youthful impetuousness. I made up my mind to be wise carefully, conservatively. Everybody knew that the way to do that was to take profits and buy back your stocks on reactions. And that is precisely what I did, or rather what I tried to do; for I often took profits and waited for a reaction that never came. And I saw my stock go kitting up ten points more and I sitting there with my four-point profit safe in my conservative pocket. They say you never go broke taking profits. No, you don’t. But neither do you grow rich taking a four-point profit in a bull market." Jesse Livermore

07 June 2010

SP June Futures Daily Chart

The SP futures were selling off after the close of cash trade and went out on the low of the day around 1047.50.

That is some big support down at the prior lows, and if it does not stand up to a meaningful test the 990-1000 level beckons.

The performance of gold today, moving sharply highly in terms of dollars while US equities were falling was interesting, but the sharp rally in silver was stunning. This tends to lend some credence to the stories of a developing short squeeze in bullion that we keep hearing about. With the right catalyst we might see something pretty spectacular. But as always, play the probabilities if you want to remain standing in this game. The way to take advantage of the unexpected is by having core positions in a bull market trend and never touching them while the trend remains intact.

The June futures will be rolling over to the September contract soon enough, so we will be changing this chart. The basic shape of the formations will remain the same, but the support and resistance levels will change because the later month carries a different premium to the cash market.

SP futures drop again into the fourth circle of hell.

Gold Attempting To Break Out to New Highs

Gold is attempting to break out and confirm its cup and handle formation. It moved sharply higher on increasing volume right after the PM fix ($1,215) at the LBMA in London. If it can surmount resistance just above it may do a breakaway gap higher some evening and keep going. I will be a little surprised if it can break out quickly and in one move. Backing and filling the breakout is more likely, unless there is some sort of default in progress, or a heightened risk of a failure in the paper markets somewhere. I thought it was interesting that the rally was triggered off the PM fix in London, the 'fractional reserve' bullion market.

Some accuse me of being too conservative in my gold forecasts. Or at least they do when it rallies. Others think I am far too optimistic, but from economic theory most appropriately described as faith-based, but profanely so.

Let the charts speak for themselves. But however it develops, I will say that what we are witnessing is a generational monetary phenomenon, at least for those who have the eyes to see it. This is one of the few things of which I have been certain, and looked for it starting in 1999 when it became obvious that the dollar could not sustain its role as a gold substitute with the stability that is required of the world's reserve currency.

I am getting more anecdotal information of panic buying of physical bullion especially from substantial holders of 'old money' and amongst some of the average investors in Europe and Asia. I do not think that the public by and large has even started to buy bullion in the States. When they do the Comex will be overwhelmed and simply default, and then the situation will intensify as even more financial frauds and semi-official corruption begins to be revealed across many markets and institutions that have been operating in secrecy.

"Every thing secret degenerates, even the administration of justice; nothing is safe that does not show how it can bear discussion and publicity." John Emerich Lord ActonFor the most part Americans, and perhaps it would be fair to say even most of the English speaking peoples, are still moving through life blissfully and largely unaware of the global currency crisis and its implications for them, with a few notable exceptions. The trust they have placed in their politicians and institutions is being badly abused, and they will be shocked if the extent of its breadth and depth, the secret dealings and corruption, are ever exposed.

The details of each chart are unique, as is every breakout. So far the gold action suits the overall framework, but it would be a mistake to look for a perfect duplication, particularly in markets that are tainted with paper manipulation and semi-official fraud.

The Great Recession

Employment figures clearly show that this is much more than a cyclical recession. It is the breaking of an historic credit bubble, made worse by the Fed's policy responses and recommendations on banking regulation since 1994.

If you look closely at the chart below, you will see that if you subtract the temporary government hiring for the Census, there is no recovery in employment. It is flat. With all the trillions spent so far, why is there such a weak response?

You cannot kick start something with a quick blast of stimulus if it is still broken. So any stimulus to the economy or subsidies to the banks that are being applied are essentially wasted, until the system is significantly reformed and restructured. That is the problem.

Worse than wasted really, because it robs future governments of the ability to engage in constructive action. Like a third world country, the pigmen were the first to the trucks, with the help of corrupt politicians, and are stealing the aid intended for the public and have been hoarding it.

Stimulus. Reform. What we have seen so far from the Congress, the Fed, and Wall Street is simply white collar looting, and ironically in a crisis which they created.

And when the investigations and trials come later, which they will, watch how the pigmen claim complete ignorance of any wrongdoing even in their own companies or at most a few sincere errors in judgement, just like the CEO's and bankers and the financiers have been doing already in front of the Congress and the FCIC.

Hyprocrites and liars playing the public, whom they secretly despise as their inferiors, for fools. This is the prevailing attitude in Washington, the mainstream media, and on Wall Street.

This excellent chart is from Calculated Risk.

And as an aside regarding purported sources of our troubles, an Economic Chupacabra sighting in the People's Republic...

"Many people believe Goldman Sachs, which goes around the Chinese market slurping gold and sucking silver, may have, using all kinds of deals, created even bigger losses for Chinese companies and investors than it did with its fraudulent actions in the US.” China Youth Daily

06 June 2010

Silver Charts and a Look at the SP 500 Long Term Cash Chart

Several readers have asked for thoughts on the silver charts.

Silver normally functions as both a monetary and an industrial metal. This provides it with a higher beta (risk variation both on the upside and downside) than gold, and a stronger correlation to the SP 500.

So if one is looking at silver, one first has to ask, what do we think the SP 500 will do next, and then, what will gold do next?

SP 500 Long Term Cash Chart

The SP 500 is at a point where it will either find a footing and break back high according to its longer term bull trend, undoubtedly with serious assistance from the monetary authorities and their banking cohorts, or it will break down further and activate a more serious decline and a H&S topping pattern.

My bias now is for further weakness to the downside, possibly even a false breakdown, and then we will look for the turnaround to gain traction IF volumes remain light and there is no panic selling.

If there is a further decline, let's see if it can hold the 1000 area where there is a long term bottom of the bull trend channel.

Silver Daily Chart

In the short term silver appears to have further downside. How much is a very open question.

If and only if the SP 500 falls out of bed and there is a general liquidation of assets, silver may trigger a short term H&S top and fall down to the target area in green. There it is likely to be a singularly attractive trading buy, but we would have to look at the overall market landscape and the Fed's monetary actions.

Silver Weekly Chart

The weekly chart appears much stronger than the daily chart, suggesting that if there is a breakdown it might be short term, and look much worse on the daily chart, an intra-week spike down on the longer term chart. Again it is hard to say because the SP 500 is such an important variable in this.

I doubt very much that silver and the SP 500 will diverge. Gold however is more likely to diverge from stocks if it comes to that.

I have some confidence in Ben's and Timmy's willingness to sacrifice the dollar and the bond for stocks in the short term, and the US bond appears to be topping. The dollar DX index is looking toppy, but as I have repeatedly said this index is badly out of date, being so heavily weighted to the euro and the yen.

The way I will play this is in the obvious paired trades with little leverage and a short term bias until the situation clarifies. There is a distinct possibility that stocks, gold and silver all go up from here. These market are being driven by artificial liquidity, largely based on thin volumes, carry trades, and technical gambits by the big hedge funds and trading desks.

When you are playing in a rigged casino, don't be all that surprised if your 'systems' and indicators do not produce the usual, or even normalized, results in the short term. The intelligent individual response is to stick with the primary trends, based on fundamentals and the longer term charts, and tighten your leverage and lengthen your investment timeframes.

Or even better, stay out of trading altogether. It is a con game these days, especially in the English speaking countries.

Here is a news piece from the City that is worth reading: Why Rothschilds Is Piling Into Gold

This tracks closely with some information I had from some big private money people in the States, particularly in the old money northeast US.

04 June 2010

US Total Government Debt Reaches 130% of GDP

Here's a postcard from off-balance-sheet country.

This includes only current debt and not future unfunded obligations.

I like to call this US debt chart "The Last Bubble," but it could equally apply to a chart showing the representation of this debt - the US bonds, notes, bills and of course dollars, which are really nothing more than Federal Reserve Notes of zero duration in the modern fiatopia.

It all adds up, eventually, and must be reconciled. It is easier to print money and accumulate debt when you own the world's reserve currency. For a while the dollar might even flourish, despite the printing, as the international savers flee ahead of the economic hitmen, from country to country, and crisis to crisis.

Chart compliments of the Contrary Investor.

Gold Daily Chart Bounces Back on a Flight to Safety

Gold often functions as a safe haven because it is a remarkably universal currency, both temporally and geographically, that is not subject to the liabilities of other parties or even national balance sheets, except potentially to the upside because of fractional reserve holdings and leveraged selling. The most significant downside to gold is the animosity that is felt by those that perceive it as a threat to the status quo, in this case the US dollar as the global reserve currency.

Silver is less constructive because it acts as both an industrial metal and a currency but with a high beta. Longer term is has significant potential, but in a crisis it will not perform as well as gold.

A reader informs us that 'investment gold' is exempt from the 15 to 20% VAT in Europe, whereas silver is not. This represents the thinking in Europe that gold is money, an alternative form of money or currency. So therefore as the Europeans seek safe havens in the event of a euro decline or devaluation, they are flocking primarily into gold and dollars, for which there is no VAT, and secondarily into other investments like silver, diamonds, etc.

The miners are a stockpicker's vehicle even in good times, but especially so in a bear market, since they are correlated to the SP 500 as well as the metal, often with significant leverage correlated to their cash flow and financing requirements.

SP Daily Chart: Looking Ugly as Baghdad Barrack Declares Economic Victory

The administration had nothing constructive to say this morning except for mindless sloganeering by the likes of Christina Romer, Obama's chief on the Council of Economic Advisor, who is unlikely to inspire confidence when delivering even good news, much less a clear sign of economic policy errors and a double dip in the making.

With Romer, Summers, and Geithner, the President has managed to put together the economic scream team. Even Volcker is starting to look tired and ineffective. His recent proposal of a VAT, the most regressive of taxes, sounded less like a democratic reform and more like something from the Bilderberg playbook. One has to wonder how long will it be until they start recommending the sale of key sovereign assets to corporate oligarchs.

And then there was Baghdad Barrack, talking up the economy and the jobs numbers this morning at a Maryland truck garage. He seems to be trying to run a bluff, talking his way past his team's economic policy errors and corruption, a reflexive strategy that may have served him better when he had no real responsibilities or quantifiable results.

One might feel better if the other party had not already proven itself to be the party of the elite and the wealthy special interests, without vision or ability, creating many of the problems that are sinking the US today. Things do indeed seem bleak when the reform government fails.

It appears that the SP futures may be forming a bear flag, with another big step down to follow. That would be 'bad news' because below the support at 1040 is a disturbing possibility of a triple digit SP 500.

Chart Updated at 3:30 EDT

03 June 2010

Gold Daily Chart: A Typical Fibonacci Retracement Pattern So Far

The key support levels in the pullback from the handle resistance are 1205, 1198, and 1190. These are the three key fibonacci retracement levels, although it would not be completely unusual to see a pullback to 1166. I don't think it will happen, but the market will have the final say and we must listen.

This has the look of a bear raid by the funds and banks. They were hitting the mining stocks hard first, and then the metals. The planting of negative articles and comments by funds with friendly authors was also apparent, to the point at times of silliness.

And there are plenty of investors who have missed the rally, or with a certain ideological bias, who want to see prices fall. Misery loves company. The irony is that most will never bring themselves to buy back in, because they are always looking for THE bottom, and a lower price. They will more likely buy closer in the second leg higher, when fear overcomes their greed.

This is how bull markets operate, and the reasoning behind chart formations. Charts attempt to capture typical market behaviour, and nothing more than this. They influence some trading if enough people follow them, but by and large they cannot change the primary trend. And so far this looks like a typical bull market climbing a wall of worry. Let's see if anything changes.

The 1206.80 price on the chart is as of 2:45 PM EDT.

Here is a chart comparing the Gold Bull Market compared to the famous Dow Jones Industrial Bull Market, courtesy of Mark J. Lundeen who posted it at LeMetropoleCafe.

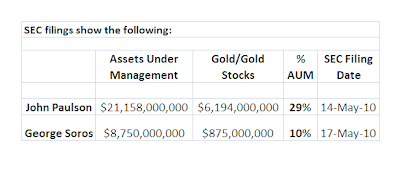

And finally, h/t to Tarlton Long, here is an example of some of the 'rubes' who are holding gold in their portfolio and its percentage of their Assets Under Management.

And finally Harvey Organ's June 2 Gold and Silver Commentary is worth reading.

02 June 2010

Obama Gives Us a Hint: Look for a Hot Jobs Number on Friday - Mission Accomplished

Since he is the commander-in-chief of the Washington bureaucracy that churns out government statistics, it is a good bet that the boss' expectations will be met by those who serve him. So watch those short positions into this Friday's Non-Farm Payrolls report. The President has declared that an economic recovery is at hand.

Since he is the commander-in-chief of the Washington bureaucracy that churns out government statistics, it is a good bet that the boss' expectations will be met by those who serve him. So watch those short positions into this Friday's Non-Farm Payrolls report. The President has declared that an economic recovery is at hand.

Obama gave a longish speech at Carnegie Mellon University in Pittsburgh today blaming most of the problems in the US on the Republicans and a few greedy Banks, extolling the reforms in healthcare and the financial system that he has been able to push through despite the minority opposition, and recalcitrant leftish supporters, after he saved the country by the unfortunate but unavoidably necessary bank bailouts.

His speech sounded good. And if you do not look too closely at what is going on, and how things are being run, and the lack of actual reform, you might have had a feel good moment. It was about as effectively staged as the case that George W made to the American people for the invasion of Iraq. And it was probably just as phony and self-serving.

I come away feeling that Lincoln had it exactly right. There will be a die hard group who will never lose faith in their party, or any of their chosen leaders, and will find desperate comfort in partisan blindness.

"If you once forfeit the confidence of your fellow citizens, you can never regain their respect and esteem. It is true that you may fool all of the people some of the time; you can even fool some of the people all of the time; but you can't fool all of the people all of the time." Abraham LincolnBut the great majority of the American people are waking up, and that spells trouble in the November elections for most incumbent politicians. So the pace and velocity of the spin will have to be adjusted. Hence the speech today. And the outlook for the tortured American economic system, and the official descriptions of it.

For a refresher, here is Matt Taibbi's caustic expose of the financial reform process. Wall Street's War

Dow Jones Newswire

Obama Says He Expects Strong US Jobs Report Friday

By Jared A. Favole

WASHINGTON -(Dow Jones)- President Barack Obama, speaking Wednesday at Carnegie Mellon University on the economy, said he expects strong job growth to be reported Friday.

The Labor Department is scheduled to report May's employment statistics Friday. Economists expect the unemployment rate to slide to 9.7% from 9.9% in April and for the report to show the U.S. added as many as 515,000 jobs last month after non farm payrolls rose by 290,000 in April.

Obama said an economy that was "once shrinking at an alarming rate" has now grown for three consecutive quarters and is moving in the right direction.

I watched this speech live on Bloomberg television. It is no exaggeration. Obama was declaring mission accomplished, for the record. So if something beyond his control should happen to derail the recovery, well, that could not be his fault.

Bank of Canada Becomes First of G7 to Raise Interest Rates

Interesting move by the Bank of Canada to raise, albeit cautiously, its key interest rate by 25 basis points to .50%.

The reason for the increase is the obvious 6.1% growth in 1st quarter GDP led largely by housing and consumer spending, counterbalanced by slack inflation and wage growth.

So, Banque du Canada wishes to take a little off the top of its own housing bubble, and please its friends in the US by strengthening its currency against the dollar, so as to not further imbalance the significant exporting activity between the two trading partners.

I doubt very much that Canada will raise again in July, especially as the non-recovery in the US becomes more apparent. As I recall Canada fared much better in the last Great Depression because their more conservative banking sector required less reform, and offered less damage to the real economy. It appears that this will work in their favor again, despite some looming problems perhaps in housing.

Still, it is interesting to see the commodity strong countries like Australia and Canada raising rates even while Europe and the US economies remain wobbly.

Bank of Canada Press Release

Bank of Canada increases overnight rate target to 1/2 per cent and re-establishes normal functioning of the overnight market

OTTAWA – The Bank of Canada today announced that it is raising its target for the overnight rate by one-quarter of one percentage point to 1/2 per cent. The Bank Rate is correspondingly raised to 3/4 per cent and the deposit rate is kept at 1/4 per cent, thus re-establishing the normal operating band of 50 basis points for the overnight rate.

The global economic recovery is proceeding but is increasingly uneven across countries, with strong momentum in emerging market economies, some consolidation of the recovery in the United States, Japan and other industrialized economies, and the possibility of renewed weakness in Europe. The required rebalancing of global growth has not yet materialized.

In most advanced economies, the recovery remains heavily dependent on monetary and fiscal stimulus. In general, broad forces of household, bank, and sovereign deleveraging will add to the variability, and temper the pace, of global growth. Recent tensions in Europe are likely to result in higher borrowing costs and more rapid tightening of fiscal policy in some countries – an important downside risk identified in the April Monetary Policy Report (MPR).

Thus far, the spillover into Canada from events in Europe has been limited to a modest fall in commodity prices and some tightening of financial conditions.

Activity in Canada is unfolding largely as expected. The economy grew by a robust 6.1 per cent in the first quarter, led by housing and consumer spending. Employment growth has resumed. Going forward, household spending is expected to decelerate to a pace more consistent with income growth. The anticipated pickup in business investment will be important for a more balanced recovery.

CPI inflation has been in line with the Bank’s April projections. The outlook for inflation reflects the combined influences of strong domestic demand, slowing wage growth, and overall excess supply.

In this context, the Bank has decided to raise the target for the overnight rate to 1/2 per cent and to re-establish the normal functioning of the overnight market.

This decision still leaves considerable monetary stimulus in place, consistent with achieving the 2 per cent inflation target in light of the significant excess supply in Canada, the strength of domestic spending, and the uneven global recovery.

Given the considerable uncertainty surrounding the outlook, any further reduction of monetary stimulus would have to be weighed carefully against domestic and global economic developments.

Information note:

The next scheduled date for announcing the overnight rate target is 20 July 2010. A full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the MPR on 22 July 2010.

Net Asset Value of Certain Precious Metal Funds and Trusts

Sprott completed its premium-busting unit offering and is now using the cash proceeds to procure bullion for the fund at an aggressive pace that suggests that it had made arrangements beforehand.

SP June Futures Daily chart

This market seems to be all technical play, lacking genuine investment interest as opposed to short term speculation.

If the 1070 level cannot hold into the open we will problem go down to retest that low around 1035.

Non-farm Payrolls report at the end of this week. Watch out for more games, wash and rinse. But a 'bad number' could be the spike in the rally hopes for those of the bullish persuasion. Since I do not view this market as 'real' and engaged in price discovery it is hard to operate in it with conviction.

01 June 2010

31 May 2010

Remember

"Judge of the Nations, spare us yet.

Lest we forget—lest we forget."

"The Revolution was effected before the War commenced. The Revolution was in the minds and hearts of the people; a change in their religious sentiments of their duties and obligations ... This radical change in the principles, opinions, sentiments, and affections of the people was the real American Revolution." John Adams

29 May 2010

Gold Daily Chart: The Handle Forms, a Reader's Questions, and Felix Zulauf on Gold

With regard to the cup and handle formation on the gold chart, a reader from Italy asks, 'Are you so sure?'

The short answer is jamais, 'never.' Only saints and fools approach certainty with reckless disdain; the experienced hedge with caution.

All charting is based on probabilities. Only fools are certain of what will happen next, and the market soon separates them from their money. In fact, 'knowing what will happen next' is the greatest single indicator of failure in trading that I have seen. All charts, all data, are selectively twisted and formed to support the outcome that one believes in. And when the like-minded collect, groupthink soon follows.

At the feast of ego, all leave hungry.

Right now this formation is indicative, a 'potential' thing that will be confirmed IF gold can break out higher. I would put the probability at about 65%, so it is a decent wager, but not more than that. As the price approaches a breakout point, the odds improve substantially.

The greatest negative is the possibility of a market meltdown in which everything is sold, at least temporarily.

This same reader from Italy suggests that gold is a Ponzi scheme. That is hardly probable since a Ponzi scheme requires a person, or small group of people, to concentrate and promote it. In the case of gold it is quite the opposite case, that the shorts hold concentrated power. I think he meant to suggest that it was a bubble, and was being a bit provocative. Although you could make the case that it is an 'anti-Ponzi' phenomenon, to the except that a fiat currency that was based in a debt Ponzi scheme is collapsing.

Well, is gold in a bubble? Gold is the 'mirror' of fiat currencies. Are governments and central banks doing a good job of protecting and maintaining the value of their currencies. Is spending well in balance with taxation? Gold is the barometer of profligacy and corruption. This is why corrupt statists fear and despise it.

Here is an interesting interview with Felix Zulauf on the global currency crisis and the gold bull market which is worth listening to carefully.

If people look back to the last great credit collapse worldwide which was the 1930's, and sees what happened to currencies and gold, they will obtain some knowledge that could very useful to them now. Stubborn ignorance can rationalize amost anything, and there is a peculiar tendency among people to resist the data that does not support their assumptions, until they are overwhelmed. They still have some hope due to the somewhat arbitrary nature of fiat currencies today, but increasingly less so for the very good reasons that Mr. Zulauf outlines in his interview.

Gold has no liabilities if you own it, it is sufficient in itself. It is also relatively stable in supply, and cannot be increased at will, as a fiat currency can be printed almost at will by a central bank but with increasingly lower marginal value in a free and transparent market.

Pierre Lassonde offers another interesting, although less rigorous viewpoint in this interview.

As a reminder I do not subscribe to the pure hyperinflationary outcome yet, which I think is not likely in the US at least. For my way of thinking, organic hyperinflation is a function of a currency with an external reference point. At the moment, the US dollar has no legitimate external standard as a reference point, except something soft, indicative, like gold. This is a truly fascinating and almost unprecedented historical development. I cannot think of a comparable economic example.

I suspect we will see powerful deflationary forces that will be countered by monetary inflation and devaluation that is not quite sufficient to break it, because quite frankly Bernanke is no Volcker, and the monied interests will resist a deterioration of their inordinate share of the dollar wealth of the world. That is not to say that various countries and even regions will not be economically 'trashed' in the process by a predatory financial sector based largely in New York, Zurich, and London.

Within eight years I would see the US dollar financial system resolving into a currency collapse and the issuance of a new dollar with a few zeros, two or three, knocked off as was seen with the rouble. It will look somewhat similar to the collapse of the former Soviet Union, not with a bang, but a whimper.

Here is a closer look of the current 'handle' being formed, and next to it the idealized example from an illustration of a classic cup and handle formation.

I would have preferred to have seen that lower bound set with at least one more test. Obviously at this point a retest would certainly try the longs. This would most likely occur if there was a major selloff in equities. Otherwise it appears that the orchestrated selling around Comex option expiration was the near term low.

Classic Cup and Handle Illustration

Gold to $1800-$2000 this year, and $30 Silver - James Turk

There are many more skeptical holdouts and the merely unaware with regard to the unraveling of the global fiat currency regime that has been in place since Bretton Woods.

As the dollar reserve currency and the euro recede into history, the pricing of gold in these currencies will become quite high, as the price of gold in old roubles had been during the collapse of the former Soviet Union. One thing that puzzles me is to speculate on which, if any, currencies will remain standing and be the big winners. Few have any backing in specie.

As the dollar reserve currency and the euro recede into history, the pricing of gold in these currencies will become quite high, as the price of gold in old roubles had been during the collapse of the former Soviet Union. One thing that puzzles me is to speculate on which, if any, currencies will remain standing and be the big winners. Few have any backing in specie.

Moscow Memories of 1997

As you will recall, the world did not collapse with the Russian Empire. Goods flowed around and out of that region to other parts of the world, creating severe shortages. Many were out of work, or not being paid as official payrolls were in default due to lack of funds. Debts were wiped out en masse. Where was the deflation?

The US may have the option to go the Japanese route of slow death rather than a purging. A decade of stagflation may be deemed preferable to an all out bust.

Few understand the difference between a recession and a currency crisis. And they tend to forget even the wisdom of their own cultural heritage, embodied in the little sayings that we so often repeat, but genuinely understand only at those rare moments in our own personal experience.

"...the harder they fall."

Indeed.

SP June Futures Daily Chart

So far a dead cat bounce at least. The futures settled around 1088 after a false breakout to the upside and a selloff into the close.

Next week should give us a clearer signal by how it moves out of its current trading sphere, up or down.

28 May 2010

Financial Reform: Day of the Pigmen

I Fratelli Gemelli: Infamia e Disonore

Wall Street's War - Matt Taibbi

Federal Reserve Is Intervening in the Currency Markets While Wall Street Whines about Reform

I think we all already knew this, but I wanted to bookmark it on my site for some future occasion when the government and the Fed deny it, probably in a response to a question from Ron Paul.

The question I have in my mind is where does this show up on their books, and what other markets are they active in?

It also seems a bit ironic, since the current topic of discussion on Bloomberg TV is "investor trust in freefall?" The consensus of the talking heads is that Wall Street's holy men are under attack by evil governments, particularly those of the European persuasion, and the odd US regulatory agency.

Steve Wynn is gushing about the business friendly, stable atmosphere in the People's Republic of China, as opposed to the US and those anti-business fascists in Washington. Although it is funny that he thinks the place in the US that most closely resembles China for being 'business friendly' is Massachusetts because they are willing to give him tax guarantees for 15 years. I suppose that when you turn them upside down all corrupt oligarchies look alike.

In an email this morning my friend Janet T. dropped me a note about Vietnam's new bank friendly atmosphere, and wondered aloud if Jamie Dimon would take his operations to Ho Chi Minh City in the unlikely event that meaningful financial reform is passed in the US.

One can only hope. Should we take up a collection for airfare? I would love to see the terms of their bailout packages over there after the next financial crisis, which is sure to come. A water hose, bare steel bedsprings, copper jacketed ben wa balls, and a well charged car battery would probably serve for openers, instead of softball questions and false protests of indignation from Barney, Chris, and the boys which is what those meanies in the Congress frighten them with now.

German Econ Minister:

U.S. Fed Is Also Active In Currency Markets

By Roman Kessler

MAINZ, Germany -(Dow Jones)- The U.S. Federal Reserve is also active in currency markets, German Economics Minister Rainer Bruederle said Friday.

His comments come on the heels of remarks made by his Swiss counterpart who said that the Swiss National Bank purchased euros to buttress the single currency.

"It is a regular procedure of central banks," to intervene in currency markets, Bruederle said. "It is not a secret," that central banks have a foreign exchange rate target, he added.

Bruederle said "eruptive" movements have to be avoided. He previously said that China holds 25 percent of its foreign exchange reserves in euros.

-By Roman Kessler, Dow Jones Newswires, +49 69 2972 5514;

roman.kessler@dowjones.com

Read more: NASDAQ