The June Non-Farm Payrolls Report will be released on Friday, July 2. Tomorrow June 30 is the end of the quarter.

The 234th anniversary of the US Declaration of Independence is this weekend.

"I am well aware of the toil and blood and treasure it will cost us to maintain this declaration, and support and defend these states. Yet through all the gloom I see the rays of ravishing light and glory. I can see that the end is worth all the means. This is our day of deliverance." John AdamsThe equity market feels somewhat artificial, if not contrived. Indeed, I think we are in a period of intensified disinformation running ahead of the fog of war, whether it is between countries, or classes, or both. It is customary to neutralize pre-emptively the moral standing of the friends and allies of something which you intend to attack and destroy.

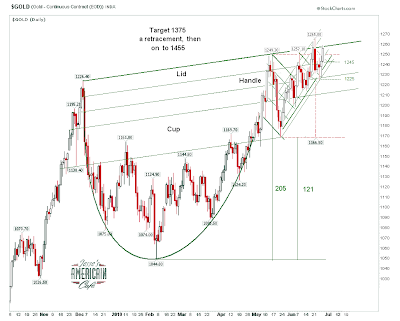

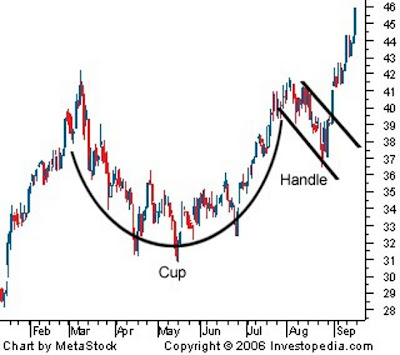

Bear raids were coming hot and heavy as Gold attempted to break out through overhead resistance. HSBC was spreading talk of Central Bank selling of bullion that did not seem to be apparent in the physical market. As you know, HSBC is one of the banks most heavily short the paper metals markets.

Chris Whalen of the highly respected Institutional Risk Analyst sees Robert Rubin as still pulling the strings in US financial policy and is virtually running the economic policy in the Obama Administration from behind the scenes, through surrogates.

"t comes as a surprise to many people that, despite the fiasco at Citigroup (C) and his role in causing the subprime mess (See "The Subprime Three: Rubin, Summers and Greenspan," The Institutional Risk Analyst, April 28, 2008), Rubin remains inside the circle at the White House. Nearly two decades after first migrating to Washington, he apparently is still calling the shots of U.S. financial and economic policy with the full support of President Barrack Obama. Working through his favorite marionettes, Treasury Secretary Tim Geithner and Economic Policy Czar Larry Summers, most recently Rubin managed the defense of Wall Street following the great crisis. No matter what Secretary Geithner says or when he says it in public, you can be sure that those utterances have the full knowledge and approval of his handler Larry Summers and their common political owner and sponsor, Robert Rubin.

A modern day colossus, Rubin effortlessly bestrides the worlds of political and finance, and mostly without leaving a trail of slime that often betrays the average political operator. Rubin stood at the right hand of Alan Greenspan on the famous February 1999 Time cover entitled: "The Committee to Save the World." Not an entrepreneur like Pierpont Morgan, Rubin is a mixture of banker, politician and global technocrat, a super fixer of sorts, but with a proper sense for public-private partnership. Case in point: The famous letter from Rubin to Goldman Sachs clients when he first went to the Clinton White House saying that just because he was in Washington didn't mean he wouldn't be looking after them...

The end result of financial reform is inconvenience for the financial services industry and more expense for the taxpayer and the consumer. But it should be noted that, once again, Wall Street has managed to blunt the worst effects of public anger at the industry's collective malfeasance. The banks can now start to focus their financial firepower on winning back hearts and minds on Capitol Hill. All it takes is money.

Notwithstanding anything said or done by the Congress this year, operating through trained surrogates such as Geithner, Summers and others, Robert Rubin is still pulling the economic and financial strings in Washington. The fact that there is a Democrat in the White House almost does not seem to matter. President Obama arguably has a subordinate position to Rubin because of considerations of money. If you differ, then ask yourself if Barack Obama could seek the presidency in 2012 without the support of Bob Rubin and the folks at Goldman Sachs. Case closed.

For America's creditors and allies, the key question is whether the Democrats around Rubin are willing to embrace fiscal discipline at a time when deflation in the US is accelerating. That roaring sound you hear is the approaching waterfall of the double dip. With the US at the moment eschewing anything remotely like fiscal restraint and the rest of the world going in the opposite direction, to us the next crisis probably involves U.S. interest rates and the dollar.

Judging by Rubin's performance in the past, when he talked first of a strong dollar, then a weak dollar policy, and fudged the issue regarding fiscal deficits, we could be in for quite a ride. But at some point the Obama Administration should acknowledge that this particular former CEO of Goldman Sachs is still driving the policy bus. If the Republicans are in control of the Congress come next January, maybe they should subpoena Rubin to appear periodically. At least then we all can hear directly to the person who is actually making national economic policy."

The World According to Robert Rubin, Chris Whalen, IRA

One has to wonder, of course, who is running economic policy for the Republicans? It seems to be more of a case of competing crime families, than a simple good vs. evil.

If Rubin does indeed run Obama, the question remains, who runs Rubin, and where do his loyalties lie? Whom does he serve?